Last week, Bitcoin failed to reclaim the critical $106K–108K resistance zone and has now fallen back into the $96K–100K band post continued geopolitical unrest.

This area marked a key accumulation range in May and is now acting as the first level of potential support. Price action is still range-bound, but the tone has changed: momentum has faded, and sellers are pressing the tape. Funding flipped negative on most major perp venues; options skew is back in moderate “panic put” territory, but realised vol remains muted (sub-40 % on a 30-day look-back). That is classic mid-cycle digestion, not end-cycle capitulation.

Altcoins

Altcoins have reacted more violently. The total crypto market cap excluding BTC (Total2) has broken through the $1.1T support band and is now heading toward $1T—a clear structural breakdown.

This follows a textbook rejection at the $1.3T ceiling that’s capped the market since March 2024. Without meaningful inflows or a shift in macro tone, downside remains the path of least resistance.

Global liquidity is offering no reprieve. The M2-adjusted liquidity index, lagged 70 days, is now flatlined for several weeks. As we’ve noted in prior weeks Insider, this flattening historically aligns with correction phases, especially in altcoins, which are more liquidity-sensitive.

With liquidity tailwinds stalling and seasonality pointing toward weaker summer flows, it’s hard to build a bullish near-term case.

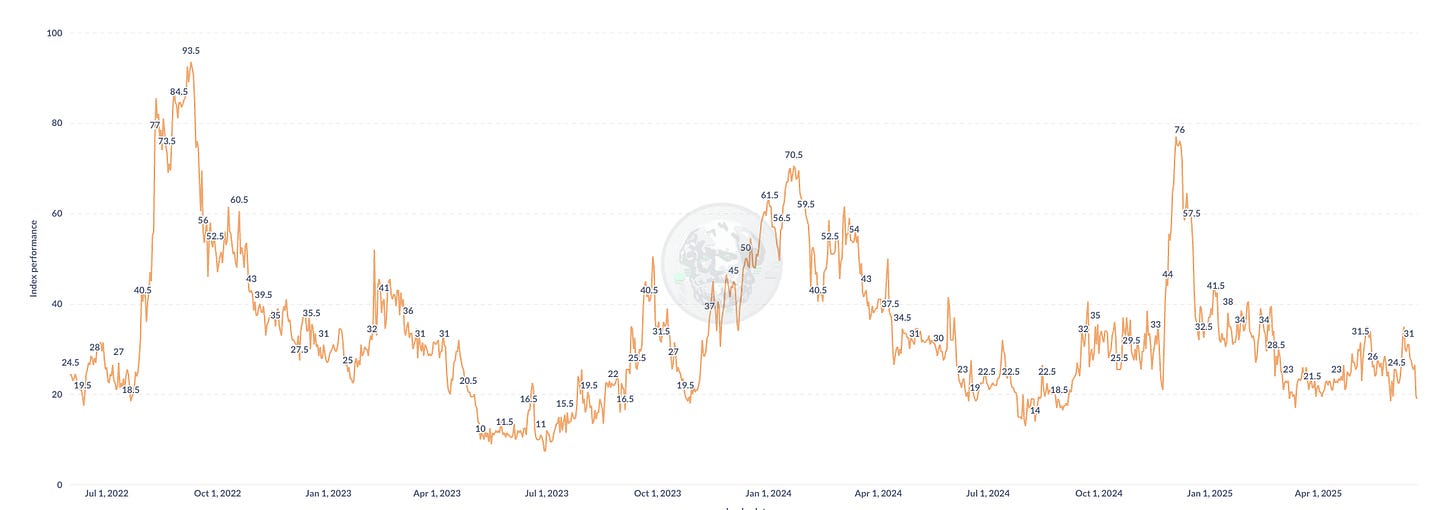

The Top-200-vs-BTC index is currently at 19, indicating only 19 % of the 200 largest tokens have performed better than BTC on a 90-day look-back, down from ~40 % start of the year.

Digging a layer deeper reveals how the risk curve is buckling.

Ranks 100-200 have held up marginally better, with ~23 % of names still beating BTC. That sliver of outperformance is almost entirely driven by illiquid idiosyncratic squeezes rather than sustainable trend; their relative-strength line rolls over every time liquidity softens.

Ranks 50-100 show the sharpest decay: only 14 % are in positive territory vs BTC. This tier tends to house “narrative tokens” whose bid disappears first when BTC dips.

Ranks 20-50, the supposed mid-cap quality cohort, are the real tell. Just 16-17 % are outperforming, a level normally associated with capitulation phases. Historically this bucket leads recoveries; its current underperformance underscores how little speculative appetite is left once the majors wobble.

Put differently, the breadth data say capital is retreating further up the quality stack with each leg lower. The dispersion spike we saw in April is collapsing into uniform weakness, confirming the macro/liquidity read: until the M2 curve re-accelerates, rallies in anything outside the top tier will be sold into, not chased.

Compounding the fragility is the geopolitical risk is flaring again. The re-escalation over the weekend from the US threw fuel on fire. While these headlines often fade quickly, the market’s reflexive de-risking behaviour is consistent: alts lead the selloff, followed by BTC weakness and volatility spikes across the board.

In this context, expect the selloff to continue. Unless liquidity re-accelerates or macro catalysts emerge, risk assets will likely bleed through summer. Selectivity, cash preservation, and defensive allocation remain essential. We remain positive medium term as we see signs of liqudity being built, read our last weeks Insider here.

Centralised Exchanges Enter the DeFi Arena

Earlier this year in The Distribution Imperative, we argued that the most valuable asset in crypto isn’t infrastructure or blockspace, but access. Distribution is what matters. Protocols win or lose not on technical merit, but on how easily users and capital can find and use them.

This month, that thesis is playing out vividly: centralised exchanges, Coinbase, Binance, and Bybit, have launched aggressive moves to integrate on-chain DeFi flows directly into their ecosystems.

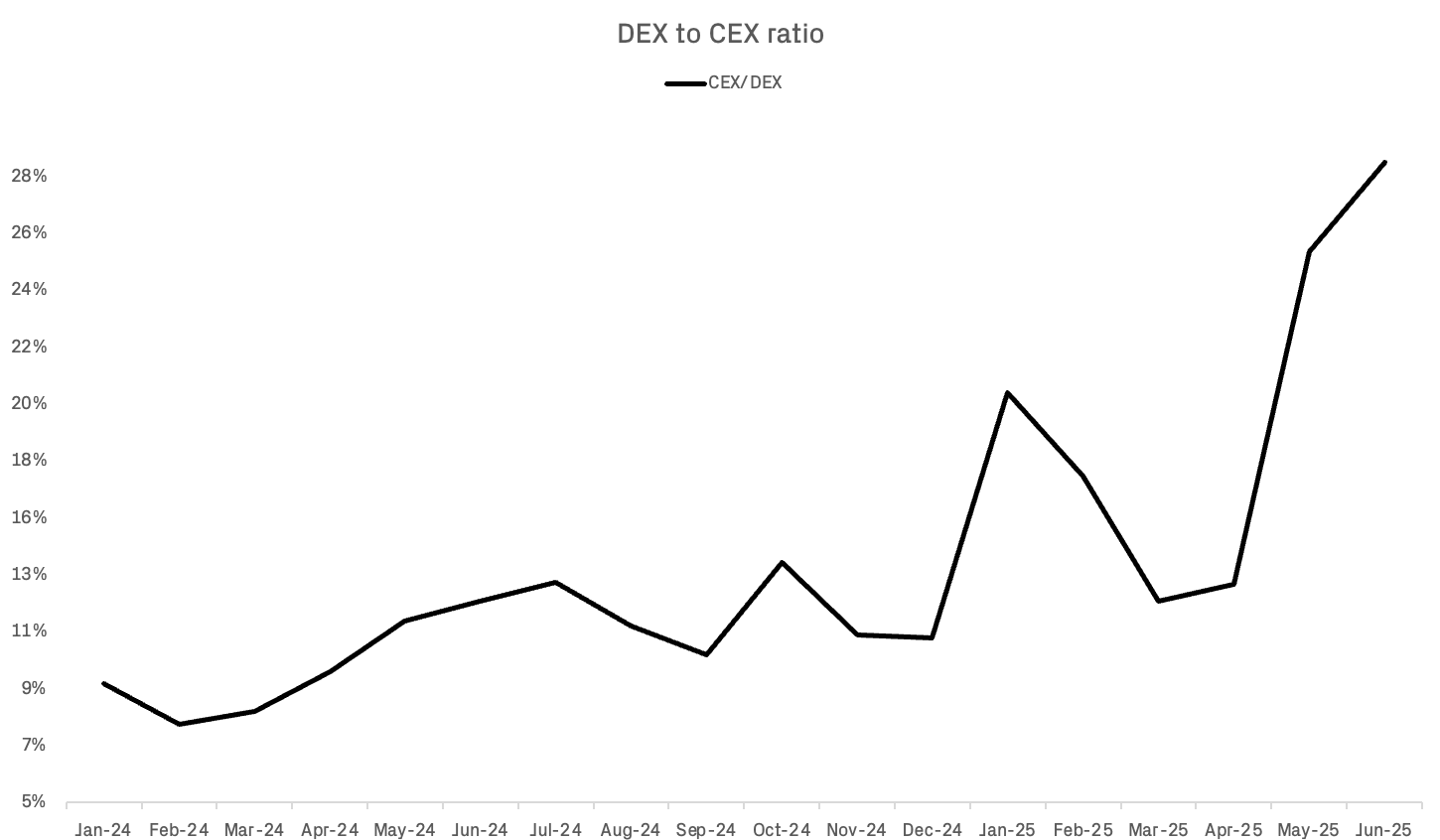

At the same time, the DEX-to-CEX spot volume ratio has climbed to a new all-time high of 26%, confirming that price discovery is increasingly occurring on-chain.

This isn’t a momentary shift. It’s a structural migration of liquidity, and CEXs are no longer ignoring it. Instead, they are adapting and fast.

Coinbase: DeFi Goes Mainstream

Coinbase has begun routing Base-native DEX trades directly through its main app. In parallel, it launched Verified Pools, a permissioned DeFi layer that wraps KYC compliance around public liquidity, making it digestible for institutions. It’s a blend of TradFi accessibility and DeFi infrastructure, rolled into a UI that millions of users already trust.

This move is not just product expansion, it’s a recognition that DeFi has matured enough to be embedded directly into consumer-facing CeFi rails. By owning both ends of the transaction (onboarding + execution), Coinbase can now guide flow from fiat into permissionless DeFi without the user ever leaving its ecosystem.

Binance: Alpha as a Pre-Listing Sandbox

Meanwhile, Binance’s Alpha initiative is a discovery funnel for early-stage tokens. Operating across multiple chains, Alpha is a curated sandbox where users can interact with unlisted tokens within Binance’s interface. The most promising assets can graduate into full listings.

This strategy blurs the line between on-chain experimentation and centralised curation. Binance is effectively internalising DeFi’s chaos, surfacing vetted experiments while still leveraging on-chain rails. It’s a distribution channel with training wheels, a funnel for price discovery that begins on-chain but gets routed through CeFi for scale.

Bybit: CEX Speed, On-Chain Spread

Bybit’s Byreal, launched this month, takes it one step further. Built on Solana, it merges RFQ (Request-for-Quote) and CLMM (concentrated liquidity) mechanics to deliver on-chain trades that feel like CEX execution, tight spreads, deep liquidity, minimal slippage.

But it doesn’t stop at execution. Byreal includes vaults, yield strategies, and fair-launch mechanics designed to retain capital on-chain from day one. It’s a full-stack play that builds liquidity, keeps it sticky, and replicates CEX performance, all while staying decentralized at the core.

The Shift: From Resistance to Integration

For years, the relationship between CEXs and DeFi was oppositional. DeFi was an existential threat: permissionless, trustless, open. Now, CEXs are embracing that threat and converting it into opportunity. They're not just integrating DeFi, they're trying to own it.

Each of these moves represents a strategic pivot:

CeFi is importing DeFi’s mechanics while maintaining its UX and compliance layers.

KYC-wrapped DeFi pools create safe perimeters that institutions can enter.

Token discovery is happening on-chain, but distribution happens through trusted frontends.

Trading, price discovery, and liquidity formation are shifting out of private order books and into permissionless environments.

Rather than compete head-on, CEXs are building hybrid stacks, Web2 wrappers around Web3 infrastructure. They're creating portals into on-chain markets that feel familiar, safe, and fast. This is not DeFi as rebellion. It’s DeFi as distribution channel.

Distribution Is Destiny

This validates everything we wrote in The Distribution Imperative: in the long run, whoever controls the capital funnel will shape the direction of crypto markets. Distribution drives adoption, traction, and ultimately protocol success. It’s not enough to build a better engine, you need the highway, the fueling station, and the signage too.

CEXs already own the fiat ramp, the UI, and the brand. Now they’re working to own the backend pipes of DeFi itself. Projects that want visibility, traction, and volume will increasingly need to conform to these hybrid standards. For builders, the message is clear: you need to be discoverable, liquid, and integrated into the new CEX-on-chain rails. DEX-to-CEX ratio at 26% confirms the shift is real. Memecoins, AI tokens, and niche plays are no longer born in centralised listings, they’re born on-chain and only later graduate into CEXs. The funnel has flipped.

In this emerging paradigm, capital allocates directly to builders and ideas. No gatekeepers, no waiting lists, just code, liquidity, and markets. That’s the Internet Capital Market thesis made real. CEXs, rather than resisting it, are positioning themselves as the primary gateways into that future.

DeFi is no longer a threat. It’s the substrate. The real war is over distribution and it’s only just begun.