The blockchain ecosystem has evolved far beyond its Bitcoin origins into a complex web of competing protocols, all vying for users, developers, and capital. Today, we face a startling reality: over 50 Layer 1 blockchains and 58 Layer 2 rollups compete in an increasingly fragmented market. Each claims technological superiority, whether through novel consensus mechanisms, programming paradigms, or scaling solutions.

Yet for all this innovation, a fundamental truth remains: technology alone doesn't drive adoption. The most technically impressive blockchain in the world means nothing without users.

This research examines the critical factor that separates successful blockchain ecosystems from failed experiments: distribution channels. We'll analyse how established gatekeepers—exchanges, wallets, and platforms with existing user bases—serve as the primary catalyst for blockchain adoption, and why incentive programs alone cannot create sustainable ecosystems.

The Power of Built-in Distribution

Ethereum's growth followed a natural progression through multiple market cycles. The initial wave came from Bitcoin users seeking more functionality. The 2017 ICO boom brought speculative interest. DeFi summer (2020-2021) attracted financial users. The NFT explosion brought creators and collectors. Each wave built upon the previous one, creating a compounding distribution effect.

This first-mover advantage translated into powerful network effects: developers built on Ethereum because that's where users were, which attracted more users, which in turn attracted more developers. By the time competitors emerged, Ethereum had established itself as the default platform for decentralised applications.

Base + Coinbase: The Exchange Advantage

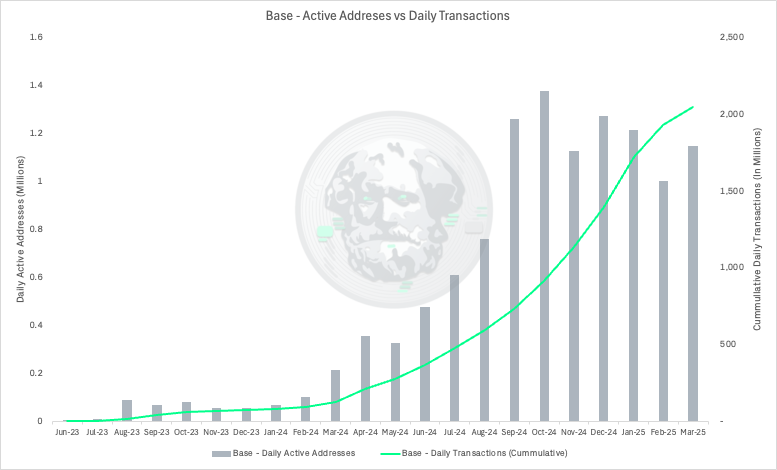

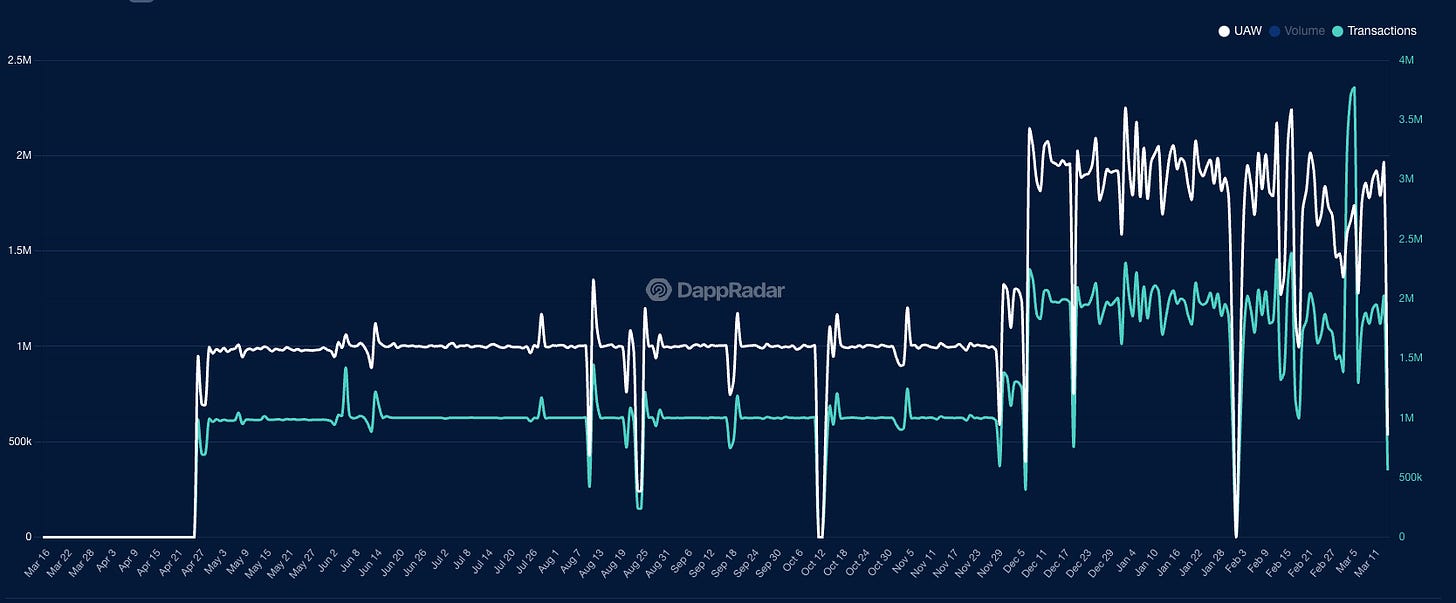

When Coinbase launched Base in 2023, they didn't just create another L2—they opened a direct pipeline from their 110+ million verified users to a new blockchain ecosystem. This wasn't merely technological integration; it was the seamless extension of a trusted platform.

The numbers tell the story. Base achieved over 100 million transactions within its first nine months—an achievement that took alternatives years to accomplish. By embedding Base directly into the Coinbase app and website, they removed the formidable onboarding hurdles that typically prevent mainstream users from experimenting with new chains.

Coinbase's advantage extends beyond retail users. Their institutional relationships provide Base with immediate access to market makers, enterprises, and financial players typically hesitant to experiment with emerging blockchains.

BSC + Binance: The First-Mover in Exchange-Backed Chains

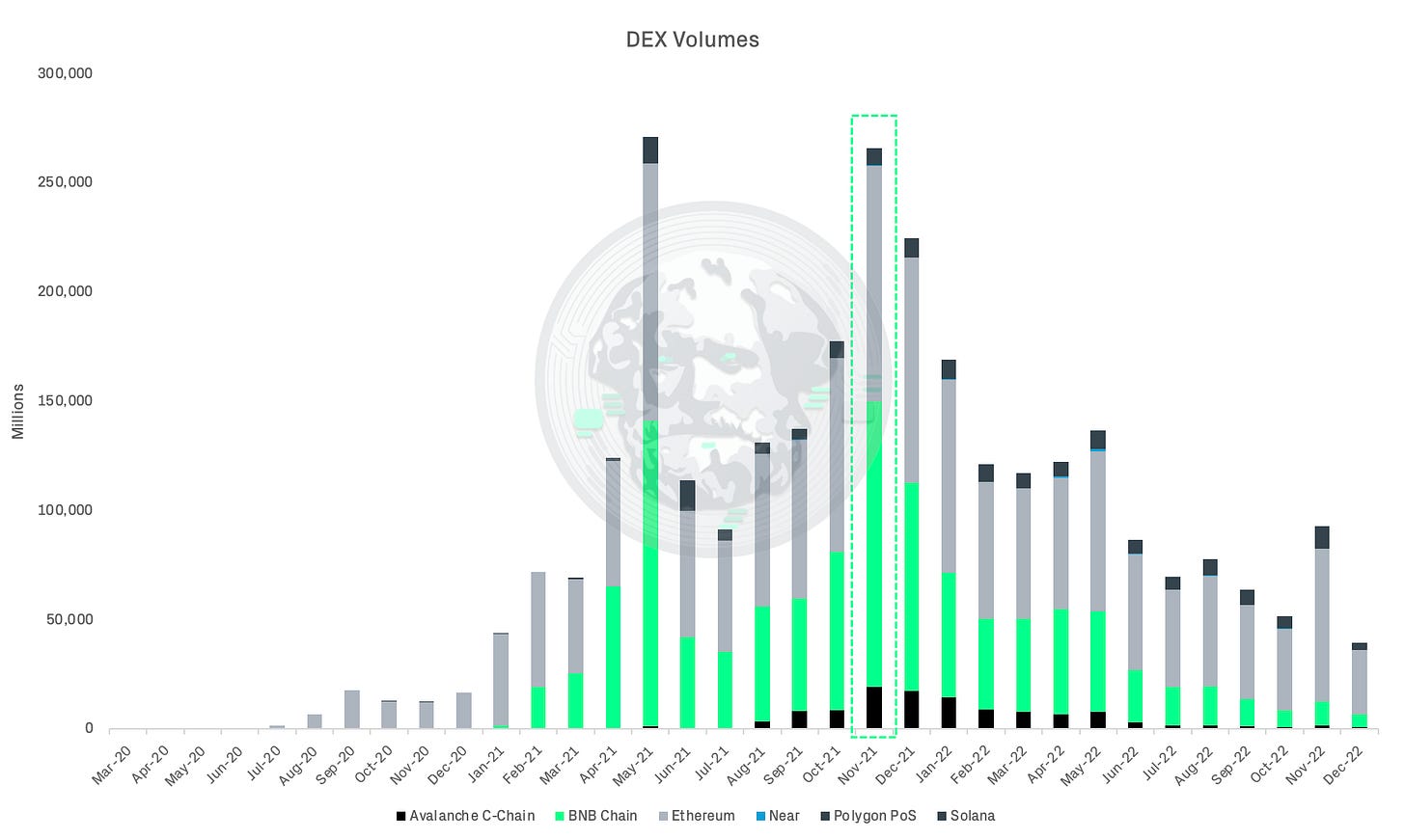

Binance Smart Chain (now BNB Chain) pioneered the exchange-backed blockchain model. By leveraging Binance's massive trading platform, BSC achieved rapid adoption that competitors spending billions on incentives couldn't match.

The key insight from BSC's success wasn't just integration—it was simplification. Binance created a one-click process to move assets from centralised exchange wallets to BSC-compatible wallets, dramatically lowering barriers for first-time DeFi users.

At its peak in Nov 2021, BSC processed over $130B in DEX volumes —more than Ethereum ($107B) and most competitors combined. This wasn't driven by technological superiority but by Binance's ability to direct its users to a controlled ecosystem where they could trade, stake, and participate in DeFi without leaving the Binance sphere of influence.

Solana + FTX/Phantom: Adapting After Disruption

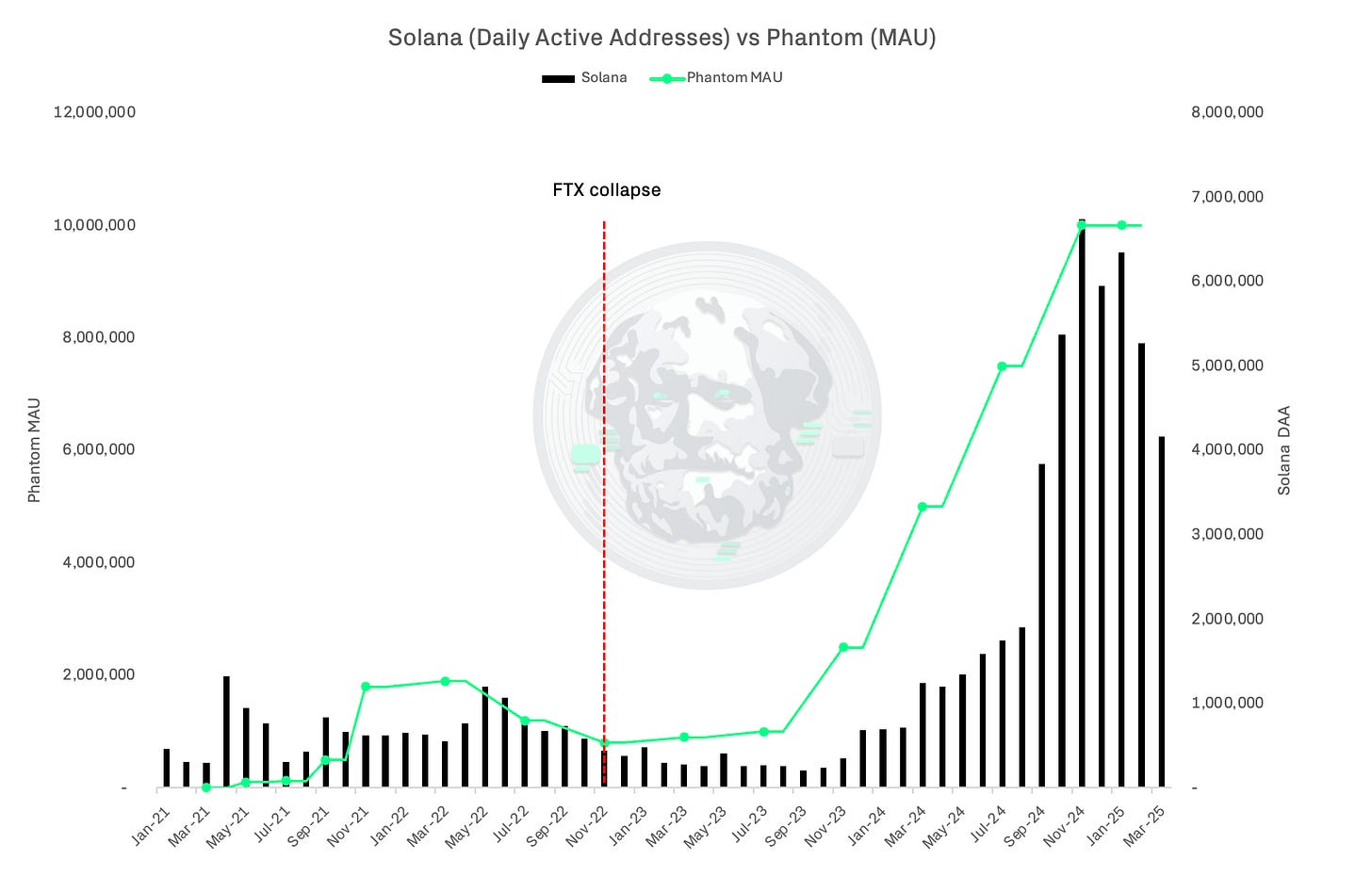

Solana's trajectory offers a cautionary tale about distribution dependency. Its meteoric rise coincided with FTX's aggressive backing, including direct integration into the exchange. When FTX collapsed in 2022, Solana lost its primary distribution channel overnight, sending the ecosystem into a tailspin.

What's remarkable is Solana's recovery. As FTX's influence waned, Phantom wallet emerged as the new distribution channel. With over 10 million monthly active users (MAU), Phantom became the gateway through which new users entered the Solana ecosystem. By prioritising user experience and simplification, Phantom recreated what Solana had lost: a low-friction path for mainstream users to access the network.

The lesson, distribution channels can evolve, but they cannot be absent. Without Phantom stepping in as the new primary onramp, Solana might have joined the graveyard of technically impressive but ultimately abandoned blockchains.

TON + Telegram: Unfulfilled Potential of Messaging as Distribution

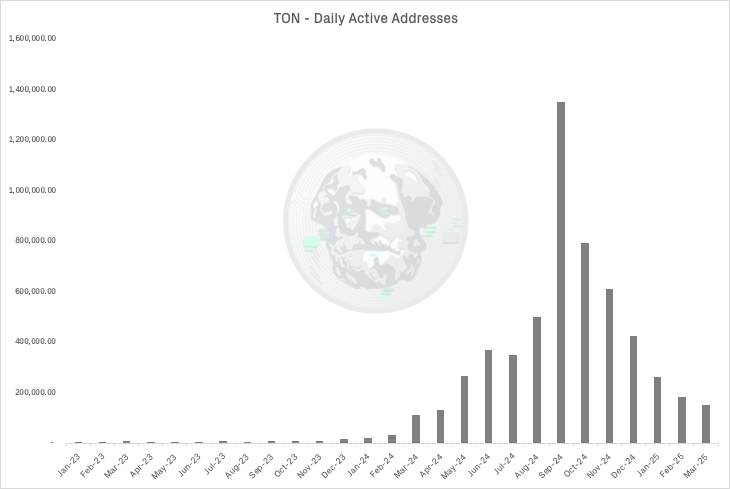

TON (The Open Network) presents perhaps the most theoretically powerful distribution channel in crypto: direct integration with Telegram's 900+ million global users. However, the reality shown in TON's daily active addresses reveals a more complicated story about distribution potential versus actual adoption.

While TON saw significant spikes in activity during 2024—peaking at approximately 1.3 million daily active addresses in September 2024 before declining—these numbers represent only a tiny fraction of Telegram's massive user base. Despite direct integration with one of the world's largest messaging platforms, TON has managed to convert less than 0.2% of Telegram users into active blockchain participants.

The TON experience highlights critical limitations in the distribution channel thesis: access alone doesn't guarantee adoption. Several factors have constrained TON's growth:

Developer friction: Building TON applications requires specialised knowledge that doesn't easily transfer from other ecosystems, creating a bottleneck in application development.

User experience gaps: While Telegram itself is user-friendly, TON applications often introduce complexity that mainstream users find prohibitive.

Limited use cases: Beyond rudimentary "click-to-earn" mechanics and basic transfers, the ecosystem lacks compelling applications that solve genuine user problems.

Under-utilised potential: Despite ideal positioning to capture the peer-to-peer stablecoin market—similar to TRON's success in this vertical—TON has yet to establish dominance in any specific use case category.

The Persistence of TVL Dominance

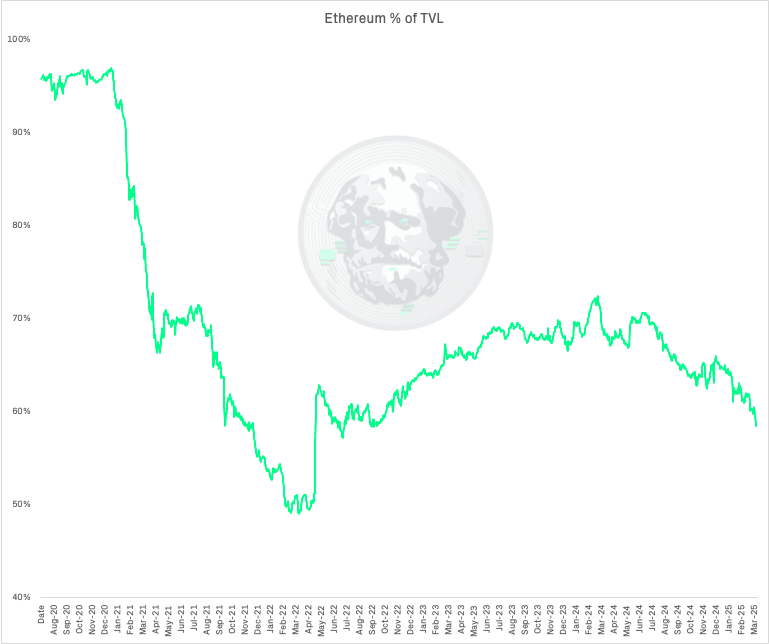

The data tells a fascinating story about ecosystem growth and user distribution. While new blockchains have emerged and attracted significant attention, Ethereum's position as the centre of DeFi liquidity has shown remarkable resilience.

Looking at Ethereum's percentage of total TVL across all chains reveals a nuanced picture. After starting with over 95% market dominance in early 2021, Ethereum experienced a gradual decline to approximately 60% by early 2025. However, this doesn't represent the exodus some analysts predicted.

The decline in Ethereum's TVL percentage coincided with the rise of alternative Layer 1s and Layer 2s, but a critical insight emerges: the absolute value of assets locked in Ethereum continued to grow even as its percentage decreased. This indicates that the expansion of the overall crypto ecosystem brought new capital into the space rather than merely redistributing existing assets.

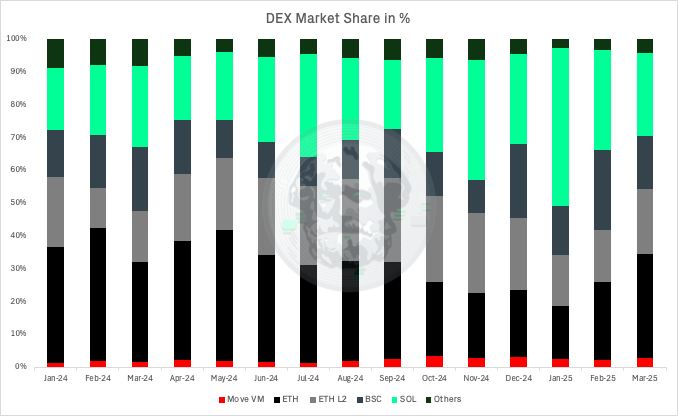

The DEX market share data further illustrates this trend. Despite initial challenges from BSC, Solana, and others, Ethereum and its associated L2s have maintained strong positions. Layer 2 scaling solutions like Arbitrum, Optimism, and Base have fulfilled their intended purpose by offloading transaction volume from Ethereum mainnet while keeping assets within its broader ecosystem.

This pattern contradicts the narrative that Ethereum would lose its dominance to more scalable alternatives. Instead, what we've witnessed is a more complex evolution: Ethereum maintains its role as the primary store of value and liquidity hub, while L2s and alternative L1s compete primarily for transaction activity and new user acquisition.

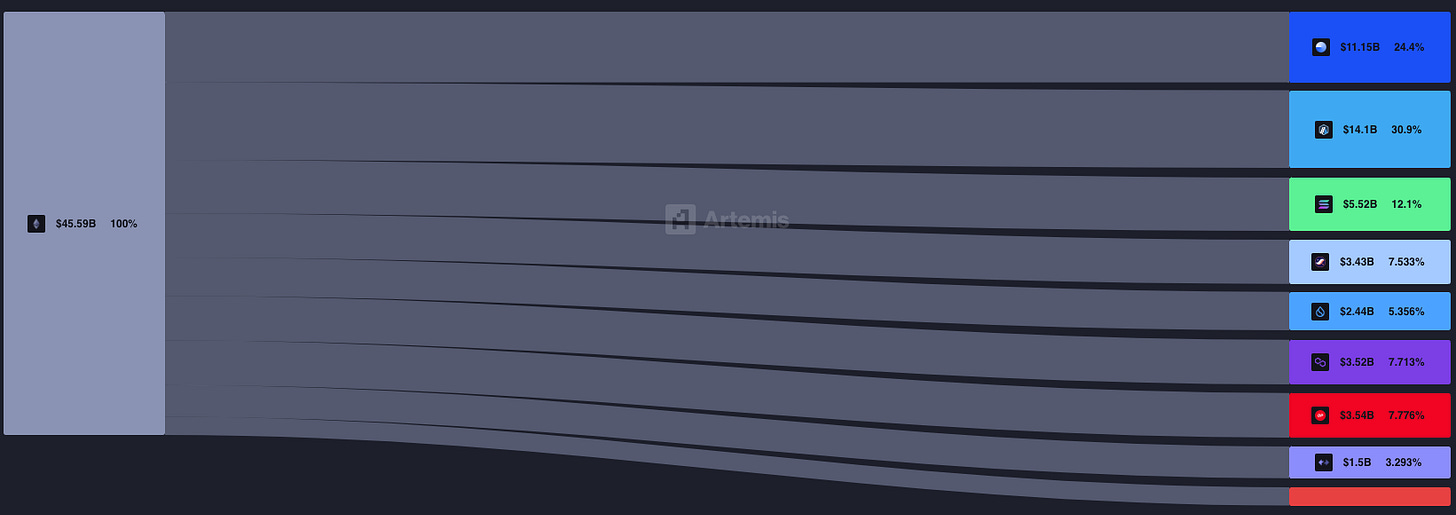

The TVL distribution chart (showing Ethereum at $11.15B, ETH L2s at $14.1B, with other chains holding smaller portions) reveals how the roll-up thesis has partially succeeded. Transaction activity has indeed moved to L2s, but crucially, these L2s remain connected to Ethereum rather than existing as independent ecosystems.

Meanwhile, chains without strong Ethereum connections have focused on acquiring new users rather than attracting existing Ethereum liquidity. This bifurcation of strategies—L2s capturing Ethereum's overflow while independent L1s target crypto newcomers—shows how distribution channels influence not just user acquisition but ecosystem positioning.

The User Growth Story

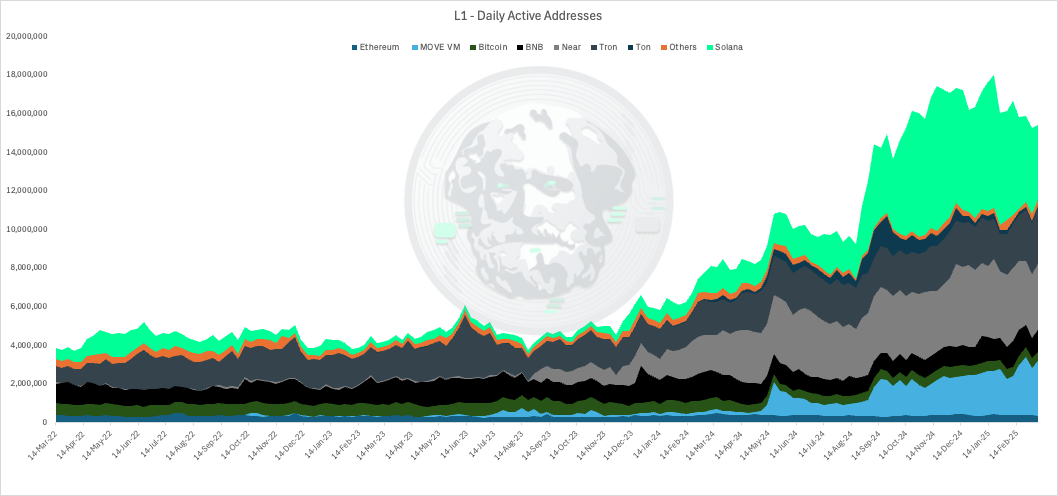

Looking at daily active addresses across major L1 blockchains reveals a compelling story about user growth and ecosystem expansion. The comprehensive data from 2022 to early 2025 illuminates how different distribution strategies translate into actual user adoption.

Ethereum demonstrates steady growth from 1-2 million to 3-4 million daily active addresses, reinforcing its position as a foundation layer rather than a growth frontier. Most remarkably, Solana dominates the growth chart, becoming the largest blockchain by active addresses despite FTX's collapse. This validates Phantom wallet's extraordinary effectiveness as a distribution channel, capable of not just maintaining but substantially expanding ecosystem momentum.

MOVE VM chains show measurable but modest activity despite significant investment, while Near Protocol displays breakthrough growth in late 2024. TON shows limited traction despite Telegram integration, and the "Others" category remains relatively small, contradicting the notion that the market is fragmenting among many specialised chains.

Despite the proliferation of over 100 L1 & L2s, this data confirms our thesis: meaningful activity concentrates among ecosystems with effective distribution mechanisms. Solana's dominance demonstrates how a well-designed wallet with strong user experience can become a more powerful distribution channel than even major exchanges or messaging platforms.

The Retention Challenge

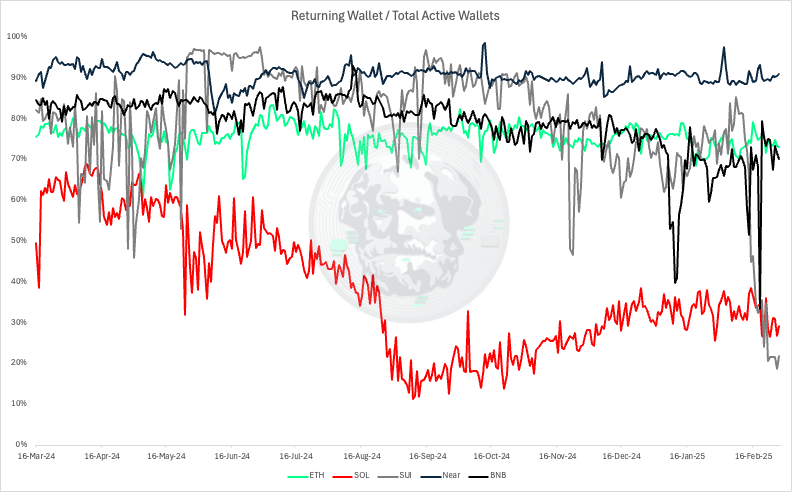

Blockchain ecosystem success depends on both acquisition and retention. Looking at returning wallet percentages from March 2024 to February 2025 reveals telling patterns:

Ethereum maintains stable retention around 75-80%, showing consistent utility for users.

Near Protocol demonstrates impressive retention at 85-95%, suggesting strong staying power despite its growth focus.

BNB Chain shows moderate volatility (70-95%), indicating periodic influxes of new users.

Solana shows the most concerning pattern—dropping from 70-80% to catastrophic levels below 20% in late 2024, with minimal recovery by 2025.

SUI exhibits similar challenges, with retention declining sharply after incentive programs ended.

These patterns prove that distribution must be paired with sustainable value. Without genuine utility, even well-distributed ecosystems will struggle to retain users once incentives disappear.

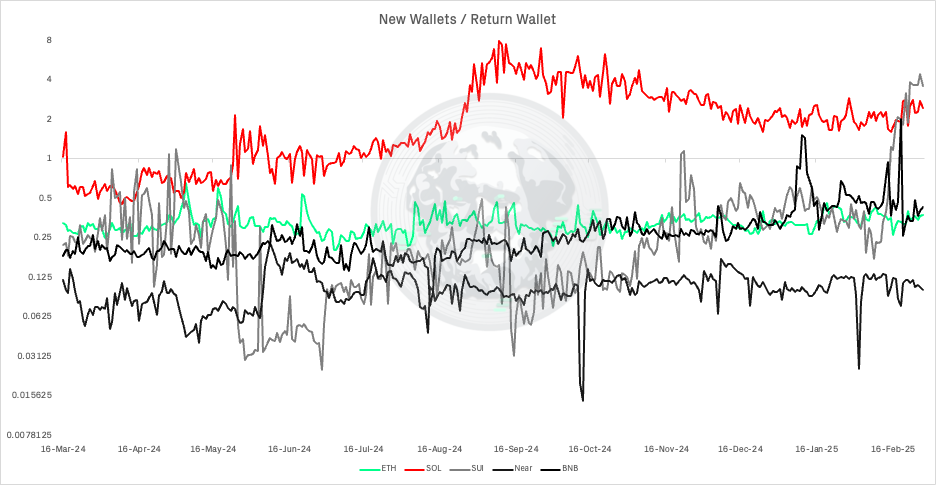

The new-to-returning ratio reveals distinctive ecosystem strategies:

Solana maintains the highest ratio (2-4 new wallets per returning wallet, with spikes to 8:1), explaining its rapid growth despite an established user base.

SUI's ratio increased significantly in early 2025, suggesting a strategic pivot after its retention crisis.

Ethereum maintains the lowest ratio (0.1-0.2 new wallets per returning wallet), reflecting its mature ecosystem focused on serving existing users.

BNB Chain shows steady growth while Near show slowdown in acceleration.

These metrics demonstrate that effective distribution isn't just about initial acquisition but creating pathways to sustained engagement. The most valuable distribution channels reach the right users—those who find lasting value and become regular participants rather than one-time visitors.

NEAR's Success vs. Move's Challenges

The contrasting trajectories of NEAR Protocol and Move-based chains offer instructive lessons in distribution strategy. NEAR Protocol initially struggled despite technological merits, but experienced a breakthrough with a strategic shift in late 2024. Rather than chasing yield farmers, NEAR focused grants on applications with mainstream appeal and familiar interfaces, growing daily active addresses from 1.1 million to 4 million in just one year.

Key to this growth was Kai-Ching, a social payment application replicating familiar fintech experiences while running on blockchain rails. Users didn't need to understand blockchain technology—they simply sent money to friends through interfaces resembling Venmo or Cash App. This demonstrates how effective distribution can be manufactured without built-in advantages by funding applications that prioritise user experience over blockchain visibility.

However, NEAR now faces the sustainability question: will this growth continue or is it falling into the "Angry Birds problem" of creating hit applications that eventually fade? Mainstream applications targeting non-crypto users typically generate lower transaction fees per user, creating economic challenges. Given the new wallets/return wallets has slowed down this indicates a overall decrease in acquisition.

In contrast, Move-based blockchains like Sui and Aptos have struggled despite legitimate technical advantages and billions in funding. The missing element? Powerful distribution channels reaching beyond existing crypto users. While NEAR created proxy distribution through user-friendly applications, Move ecosystems remain technically impressive but user-poor.

This could change dramatically if Meta were to build on either chain. Meta's Move programming experiments are well-documented, and their 3+ billion users would create the most powerful distribution channel in crypto history. Imagine Instagram integrating a Move-powered wallet for digital collectibles or WhatsApp enabling blockchain payments—the acquisition potential would dwarf anything we've seen to date.

These case studies reinforce our thesis: NEAR succeeded by manufacturing distribution through familiar applications but growth have slowed, while Move chains continue to prove that superior technology alone cannot drive adoption without effective distribution channels.

Distribution-First Strategy

For blockchain entrepreneurs, investors, and ecosystem participants, this analysis suggests a fundamental reorientation. Rather than starting with technology and seeking users, successful ecosystems will:

Identify distribution channels first: Partner with existing platforms or create familiar entry points

Design for progressive engagement: Build onramps that meet users where they are

Focus on genuine problems: Solve issues mainstream users actually face

Simplify the unnecessarily complex: Hide blockchain complexity behind intuitive interfaces

The data consistently shows that user growth follows distribution power, not technological innovation or incentive size. This doesn't mean technology doesn't matter—it does for scaling and security—but that technology alone cannot drive adoption without effective distribution channels.

Distribution Is Destiny

As the blockchain landscape continues to fragment across dozens of Layer 1s and Layer 2s, the winners will not necessarily be the most technologically advanced chains, but those with the strongest bridges to the non-crypto world.

Coinbase, Binance, Telegram, and potentially Meta represent the kind of powerful distribution channels that can transform blockchain adoption from gradual to exponential. For chains without such built-in advantages, success will depend on building proxy distribution through applications that mainstream users actually want, with experiences they already understand.

Another way forward lies in embracing what we might call the "Fat Participation Thesis" – the recognition that the ultimate value in crypto will accrue to active participants rather than solely to protocols or applications. This perspective places users at the centre of the ecosystem, acknowledging their unprecedented flexibility to move between blockchains and applications based on where they receive the most value.

The Fat Participation Thesis complements our distribution channel focus by highlighting that effective distribution isn't just about acquiring users—it's about empowering them. The most successful ecosystems will be those that not only bring users in through effective distribution channels but also give them meaningful agency, ownership, and returns within the ecosystem.

The next phase of crypto adoption won't be driven by convincing people to care about blockchains—it will come from embedding blockchain benefits into experiences so seamless that users may not even realise they're using the technology at all. By combining powerful distribution channels with participant-centric value models, blockchains can finally achieve their promise of democratising access to financial and digital infrastructure.

Distribution may be destiny in blockchain ecosystems, but participation is the fuel that will sustain them.