In traditional equity markets, the relationship between earnings growth and share dilution has been a cornerstone of value investing for decades. When a company issues new shares faster than it grows earnings, each share represents a smaller piece of the company's profits. This fundamental principle led Warren Buffett to prioritise businesses that could grow without constant capital raises, and shaped how Wall Street evaluates everything from tech startups to mature industries.

Crypto protocols face the same mathematical reality, but with a crucial twist: instead of earnings, we measure value creation through protocol fees. Just as a stock's value ultimately depends on earnings-per-share, a token's fundamental value is anchored to fees-per-token, later translating into a form of value capture for its token holders. This isn't just theory – it's playing out in real-time across the crypto landscape.

Understanding Value Per Token

Understanding value per token requires examining both revenue generation and supply dynamics. When protocol fees grow faster than token supply, a compounding effect occurs: each token commands a larger share of protocol revenue over time. This creates a virtuous cycle where increased revenue not only benefits current holders but also strengthens the protocol's treasury.

The treasury aspect is crucial yet often overlooked. As fees accumulate, the DAO gains more resources for:

Strategic investments

Protocol improvements

Emergency reserves

Future holder incentives

Consider a protocol growing fees at 30% annually with 10% supply growth. Each token's claim on protocol revenue increases by 18% yearly as fees grow to 130 while supply only reaches 110. More importantly, the growing treasury provides optionality for future value distribution mechanisms, whether through direct rewards, enhanced buybacks, or protocol development.

However, when supply growth exceeds fee growth, this dynamic reverses. A protocol with 10% fee growth but 30% supply increase sees each token's revenue claim drop 15% annually as fees only reach 110 while supply expands to 130. The treasury's growth relative to supply also weakens, reducing future distribution potential. Over time, this compounds into significant divergence in value accrual potential between the two scenarios.

The 20% difference in growth rates compounds into a 33% spread in just one year, demonstrating how critical the relationship between fee growth and supply truly is for long-term value creation.

The Numbers Tell a Clear Story

By looking at some of the largest major crypto protocols , we see a striking pattern:

Protocols with fee growth exceeding supply inflation: +120% average 1Y return

Protocols with supply inflation exceeding fee growth: +20% average 1Y return

The delta is clear: protocols that grow fees faster than supply are outperforming the total market (ex-BTC) and returned 120%, while those with higher supply growth underperform the market and only returned 20%. This 6x performance gap demonstrates efficient market pricing of fundamental value creation.

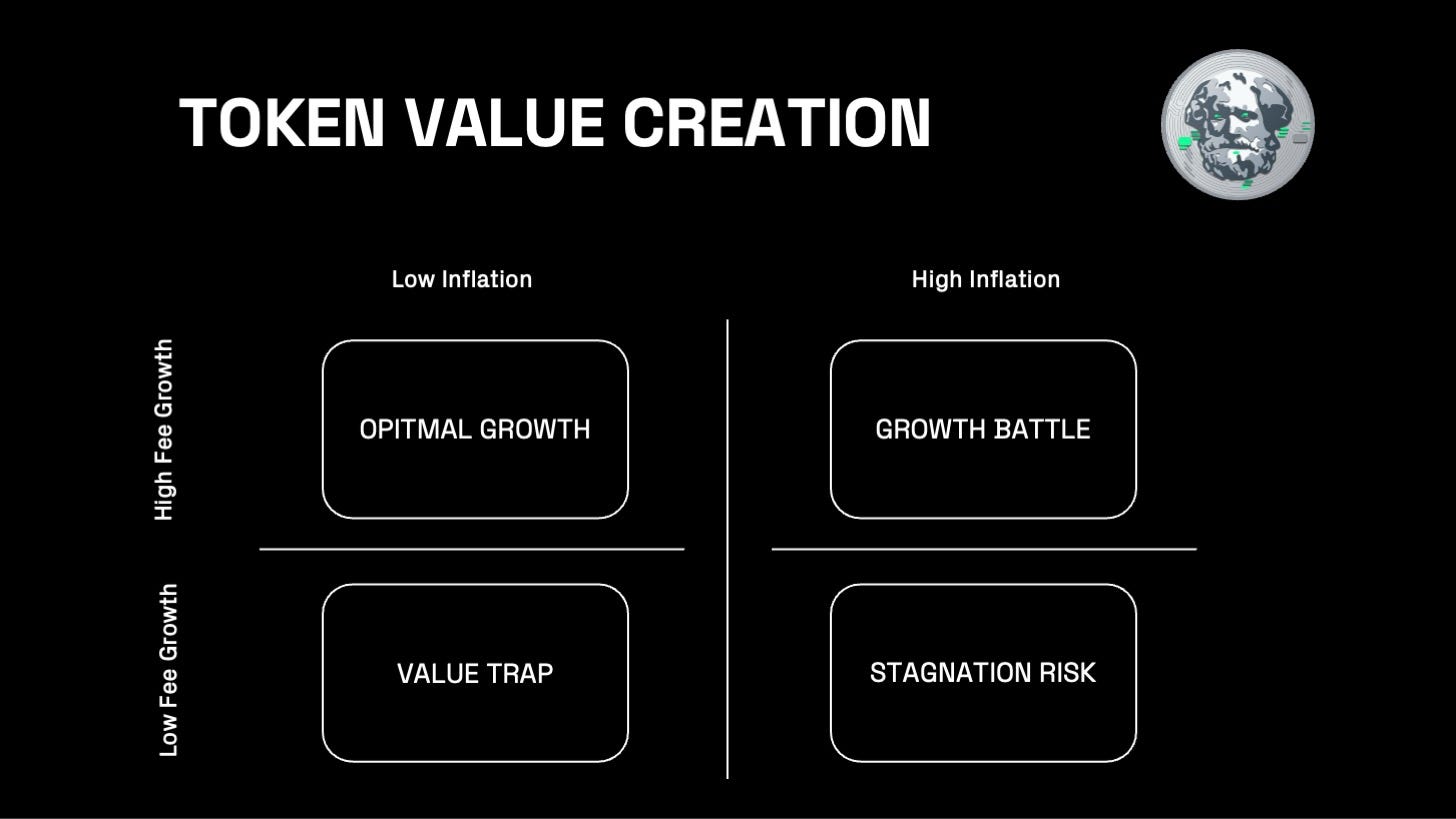

A Growth Framework

Sustainable Value Creation

When protocols generate strong fee growth while maintaining low inflation, they create a virtuous cycle of value accrual. Each token represents a growing share of protocol revenue, attracting more users and further accelerating fee generation. This compounds into sustainable growth without dilution.

Best seen in protocols like Solana and LINK, this pattern achieves strong fundamentals through product-market fit rather than token incentives. High fees signal genuine demand, while controlled emissions preserve value capture for holders. The result is significant outperformance, with average returns exceeding 240%.

Strategic Emission Growth

Some protocols choose an aggressive but calculated path: high fees matched with high inflation. While traditional finance might view this skeptically, crypto introduces different dynamics. Token emissions effectively function as customer acquisition costs, with protocol fees representing lifetime value.

Think venture metrics: CAC is paid in tokens while LTV comes through sustained fee generation. This framework helps evaluate whether high emissions are justified:

Token emissions fund initial user acquisition

If users stick around after incentives drop, temporary dilution pays off

Success requires LTV (sustained fees) > CAC (token emissions)

This model, exemplified by SUI and NEAR, can work when temporary dilution successfully buys permanent market share. The key metric isn't inflation alone, but user retention - if activity sustains after incentives decrease, the dilution was worth it. Strong performers here often transition to more sustainable emission schedules once network effects take hold.

Fundamental Weakness

The most dangerous pattern combines low fee generation with high inflation. Here, protocols lack organic demand but attempt to compensate through token emissions. As seen with ARB and APT, this creates a destructive cycle: dilution reduces token value, weakening incentives and requiring even more emissions to maintain activity.

This pattern often indicates fundamental product issues that no amount of token incentives can fix. Without genuine utility driving fee generation, inflation simply accelerates value destruction.

Market Position Erosion

Even conservative token policies can't overcome stagnant growth. Protocols like ETH and XLM in this category maintain controlled emissions but show limited fee generation. While avoiding rapid dilution, they face gradual market share erosion without clear catalysts for renewed growth.

The Value Creation Formula

The key insight is that emission rates alone don't determine success - what matters is the relationship between value creation (fees) and value distribution (inflation). High emissions can work if they build lasting network effects, but they must ultimately translate into sustainable fee generation. Watch for:

User retention after incentive programs

Fee growth trajectory relative to emission schedule

Signs of transition from high to low emissions

Organic growth in protocol activity

The market has become increasingly efficient at pricing this dynamic, creating significant return dispersion based on fundamental value creation patterns.

Low Float Tokens

Many projects launch with a small circulating supply relative to their fully diluted valuation (FDV). While this can create short-term price appreciation due to limited supply, investors must consider:

Vesting schedules of locked tokens

Emission rates from liquidity mining programs

Team/investor unlock schedules

We wrote about High FDV / Low Float last year, which usually ends up in underperformance

Token Buybacks: The Supply-Side Lever

Token buybacks have emerged as one of the most powerful mechanisms for managing value accrual in crypto protocols. Unlike traditional stock buybacks, protocol buybacks create a direct, programmatic link between fee generation and token value appreciation.

The Mechanics of Effective Buybacks

Strong buyback mechanisms serve multiple functions:

Direct Value Capture When protocols allocate fee revenue to buybacks, they create an automatic value distribution system. Each transaction directly contributes to reducing supply, creating a clear path from usage to value.

Supply-Side Economics Buybacks provide a counter-force to inflationary pressures from emissions. Even protocols with high initial inflation can maintain healthy tokenomics if buyback velocity exceeds emission rates.

Market Confidence Regular, predictable buybacks signal protocol health and sustainable unit economics. They demonstrate that the protocol generates genuine revenue and has prioritised token holder value. This contrasts with one-time burns or arbitrary supply reductions.

Buyback Design Patterns

The most effective buyback programs share key characteristics:

Revenue-Linked: Buyback size scales automatically with protocol revenue

Transparent Schedule: Clear, predictable execution builds market confidence

Strategic Timing: Some protocols concentrate buybacks during market weakness

Burn Verification: On-chain verification of token removal

Value Creation Framework

The crypto market increasingly prices the relationship between fee growth and token emissions. Our analysis shows protocols with fee growth exceeding inflation returned 6x more than those with higher emissions than fees. This isn't coincidence – it's the market efficiently pricing fundamental value creation.

Success requires looking beyond market cap to understand how protocols convert user activity into lasting value. High emissions can work if they drive sustainable adoption and fee generation. Monitor user retention after incentives end and how effectively buyback programs link protocol revenue to token value.

The market is maturing. While narrative-driven cycles continue, sustained returns flow to protocols that master the balance between growth and value capture. Focus on those showing sustainable fee growth, effective buybacks, and the ability to maintain momentum as emissions decrease.

The crypto market is maturing in its ability to price fundamental value creation. While narrative-driven pumps still occur, sustainable returns increasingly accrue to protocols that:

Maintain healthy fee growth relative to emissions

Convert temporary incentives into permanent users

Implement effective, revenue-driven buyback programs

Align tokenomics with long-term value creation

Success requires moving beyond simplistic supply metrics to understand the interplay between growth, retention, and value capture mechanisms. The winners will be those who master this balance, regardless of short-term market dynamics.