The crypto landscape has witnessed a significant shift in the dynamics of token launches over the past few years. The once-prevalent initial coin offering (ICO) model, which democratised access to early-stage investing, has gradually given way to a new paradigm dominated by private funding rounds and venture capital. This transition has brought to the forefront a new breed of tokens characterised by low float and high fully diluted value (FDV), sparking a heated debate within the crypto community about their potential implications for investors and the broader ecosystem.

As the market evolves and new projects continue to emerge, it becomes increasingly crucial for participants to understand the factors driving this trend and the potential pitfalls associated with these tokens. The growing prominence of low float, high FDV tokens has raised concerns about their sustainability, long-term viability, and impact on market dynamics. Investors and stakeholders alike are grappling with the challenges of navigating this rapidly changing landscape, seeking insights and strategies to make informed decisions.

The Evolution of Token Launches: From ICOs to Private Funding

To fully grasp the current state of token launches, it is crucial to understand the historical context and the shift from public initial coin offerings (ICOs) to private funding rounds.

In the early days of the crypto market, ICOs emerged as a revolutionary way for projects to raise funds and for retail investors to gain exposure to early-stage opportunities. ICOs offered a more level playing field, with price discovery and upside potential accessible to all participants, regardless of their financial status or connections.

However, the ICO era was not without its flaws. Many projects with little more than a whitepaper and grandiose promises were able to raise substantial sums, leading to a proliferation of scams and failed ventures. The lack of regulatory oversight and due diligence also left investors vulnerable to fraud and manipulation.

The Shift to Private Funding: Regulatory Pressure and the Rise of Venture Capital

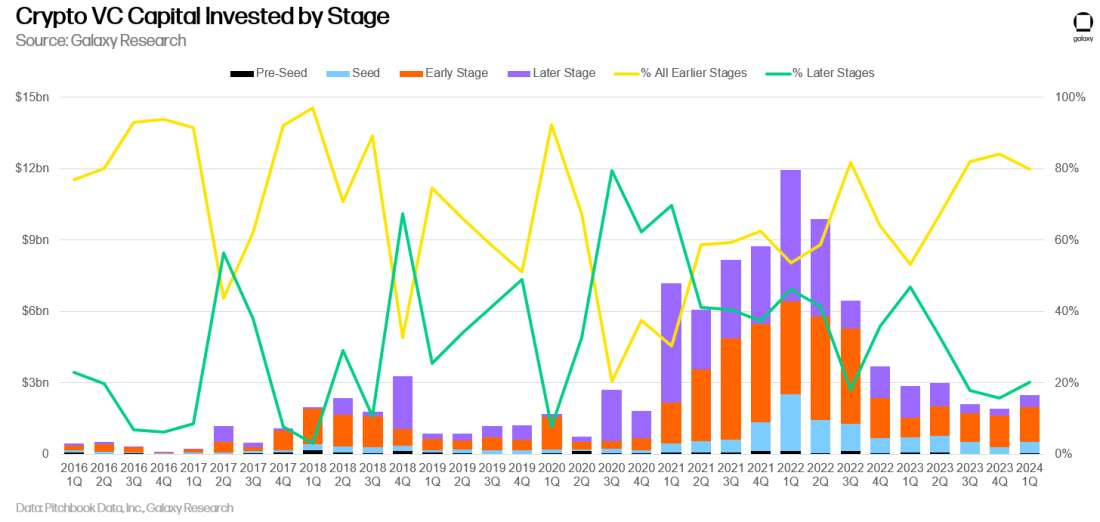

As regulatory authorities began to crack down on ICOs, citing concerns over unregistered securities offerings and investor protection, token issuers were forced to seek alternative funding methods. This led to a shift towards private funding rounds, with venture capital (VC) firms becoming the primary source of capital for crypto projects.

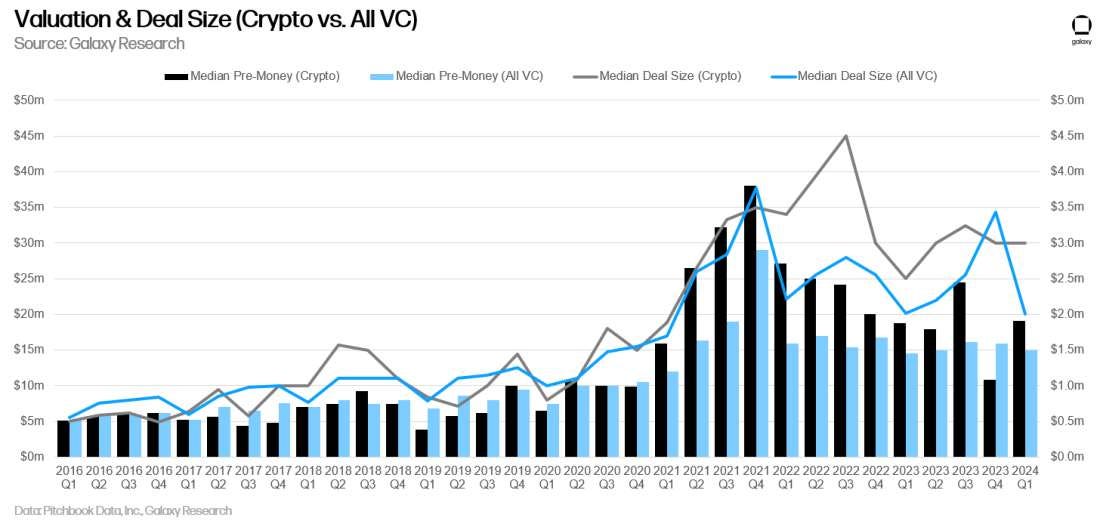

While this shift helped to professionalize the industry and introduce a layer of due diligence, it also had unintended consequences. As VC firms poured billions of dollars into the space, competition for deals intensified, driving up valuations in private rounds. This, in turn, led to a concentration of upside capture in private markets, with seed valuations reaching hundreds of millions of dollars before tokens even hit public markets.

Factors Contributing to High Valuations and Low Float Tokens

The trend of new tokens launching with high FDVs and low float can be attributed to several key factors:

I. Private Market Capital & Valuation Trends

The influx of venture capital into the crypto sector has been a key driver of high FDVs. Institutional capital has entered the market at an unprecedented rate, leading to intense competition for allocations in promising projects. This environment has fostered a "fear of missing out" (FOMO) among investors, resulting in aggressive bidding and elevated valuations.

In Q1 2024, pre-money valuations of VC-backed crypto firms rebounded by over 70% quarter-on-quarter, reflecting the heightened competition and investor willingness to accept higher valuations to secure stakes in promising ventures.

II. Market Sentiment and Investor Behaviour

The positive market sentiment in the first quarter of 2024 has further contributed to the trend of high valuations. As the overall crypto market capitalisation surged by 61% in Q1, projects have been able to capitalise on the bullish sentiment to command higher valuations in private rounds.

This upbeat sentiment is reflected in Coinmarketcap's Fear and Greed Index, which spent 69 out of 91 calendar days in Q1 in the "Greed" and "Extreme Greed" zones. This indicates a strong appetite for risk among investors, which has translated into a willingness to accept higher valuations.

III. The Allure of Low Float Tokens

Low float tokens, or tokens with a small percentage of their total supply available for trading on public markets, have become increasingly common in recent token launches. The rationale behind this approach is twofold:

Scarcity: Limiting circulating supply creates a sense of scarcity, driving up demand and potentially leading to rapid price appreciation.

Maintaining Control: Low float tokens allow projects and early investors to maintain greater control over the token's price and liquidity, managing supply to mitigate selling pressure.

However, while low float tokens may offer short-term benefits, they also pose significant risks, including liquidity issues and increased volatility.

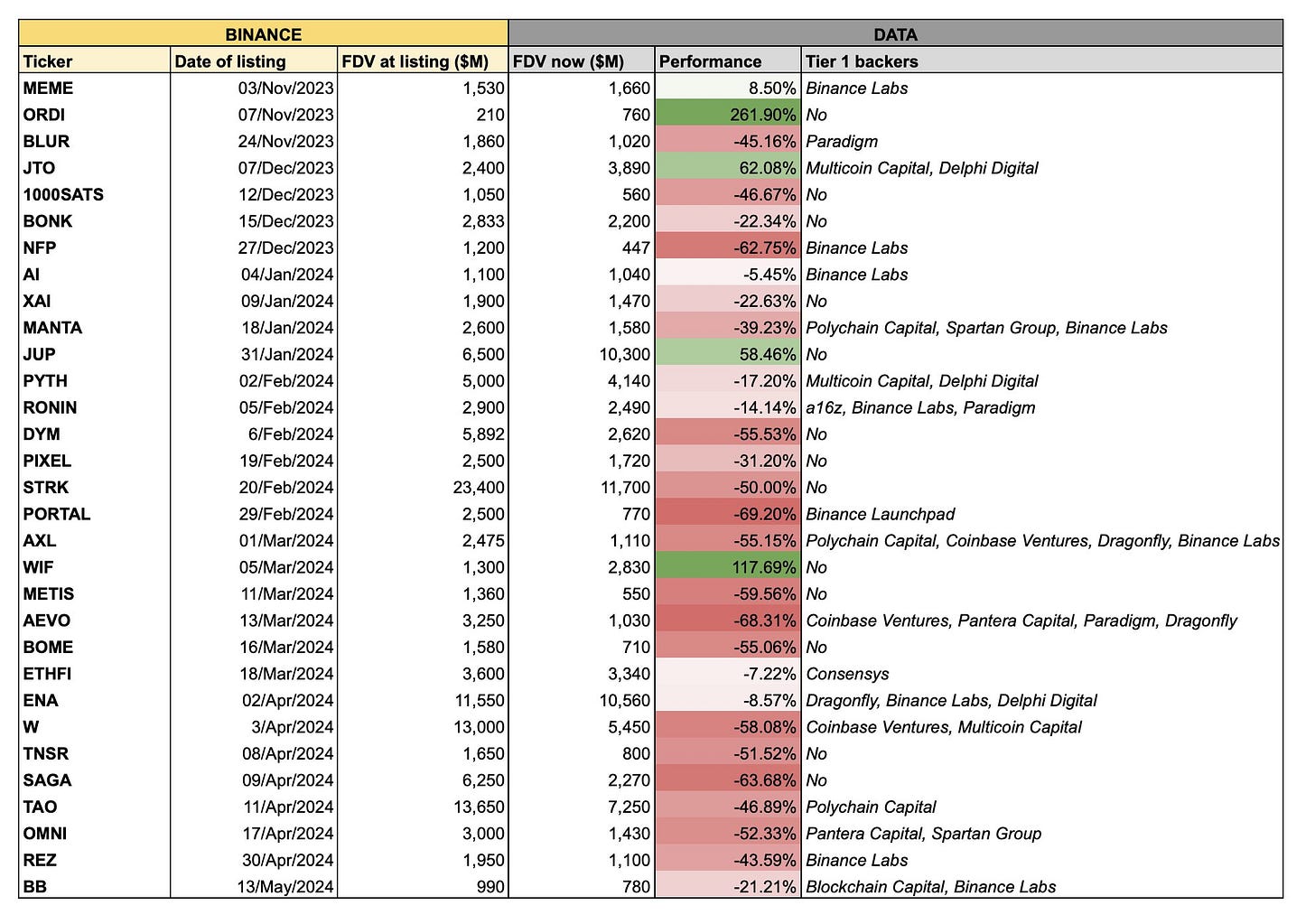

Assessing the Impact of High FDV Tokens

Favorable Outcome

In a favorable scenario, high FDV tokens can serve as a powerful tool for funding future product development, thereby driving innovation and fostering long-term growth.

For instance, projects like Decentralised Physical Infrastructure Networks (DePIN) require significant upfront capital to build their infrastructure. High FDV enables these projects to secure substantial funds during private rounds, which can be allocated towards extensive research, development, and deployment efforts. This funding approach attracts strategic partners and institutional investors, accelerating both development and market adoption. By strategically managing token distribution and release schedules, projects can create a stable and supportive investor base, enhancing long-term value creation.

Adverse Outcome

In an adverse scenario, high FDV tokens can result in significant market distortions. Inflated valuations driven by private funding rounds can lead to a disparity between private and public market valuations.

When these tokens start trading on public markets, the lack of liquidity and transparency can cause sharp price corrections, leading to losses for public investors. This situation is worsened by the concentration of upside capture in private markets, leaving public participants at a disadvantage. Additionally, the scarcity and control mechanisms inherent in low float tokens can lead to price manipulation and increased volatility, undermining investor confidence and long-term sustainability.

Market Dynamics and Token Unlocks

Launching tokens with a low circulating supply has influenced market dynamics, particularly by increasing selling pressures. According to a report by Token Unlocks, it is estimated that roughly US$155 billion worth of tokens will be unlocked from 2024 to 2030.

Although this figure is an estimate, the implication is clear—a significant amount of token supply is expected to be released in the coming years. Without a corresponding inflow of capital, many tokens will be under significant selling pressure.

Understanding token unlock schedules and tracking them is essential for investors to prevent being caught off guard when a token undergoes a significant unlock.

Rigorous Research and Selective Investment

Navigating the high FDV landscape requires meticulous due diligence. Some key considerations include:

Tokenomics: Closely examining token distribution, allocation, and vesting schedules to assess potential dilution and selling pressure is crucial. Understanding the token release schedule is essential for anticipating market dynamics.

Valuation: Evaluating key financial metrics such as price-to-sales, price-to-earnings, and market capitalisation relative to peers helps gauge whether a project's valuation is justified and sustainable.

Team and Advisors: Thorough research into the backgrounds and track records of the project's founders, core team members, and advisors is necessary. A strong team with a proven history of success in the crypto space or relevant industries is a positive indicator of a project's potential.

Market Opportunity: Assessing the size and growth potential of the project's target market, along with its unique value proposition, is essential. Identifying projects that address clear pain points or unmet needs in the market is key for long-term success.

Community and Adoption: Evaluating the strength and engagement of the project's community and looking for signs of early adoption or traction is important. A passionate and actively involved user base, as well as partnerships or integrations with established players, are key indicators of a project's viability.

Adhering to this rigorous due diligence process is vital for navigating the complexities of the high FDV landscape effectively, capitalising on high-potential opportunities, and managing inherent risks.

Conclusion

The emergence of tokens with high FDV and low float presents both substantial opportunities and significant challenges. On one hand, these tokens can provide the necessary capital to fuel long-term development and innovation, potentially leading to groundbreaking advancements in blockchain technology and its applications. On the other hand, they raise concerns about market volatility, price manipulation, and the fairness of wealth distribution within the crypto economy.

Going forward, the implications of this shift are profound. As more capital is locked up in private rounds with limited initial public liquidity, the traditional benefits of crypto investment—such as inclusivity and equal opportunity—may be undermined. This could lead to a reevaluation of what constitutes a fair and sustainable funding model in the crypto space. For the ecosystem to thrive and maintain its foundational ethos of decentralisation and accessibility, there may be a need to innovate new models of token launches.

Furthermore, regulatory frameworks may need to evolve to provide clearer guidelines for new token models, ensuring that they protect investors while fostering innovation. This involves not only addressing the risks associated with token economics but also enhancing transparency and accountability in the ways these projects are marketed and managed.

In conclusion, while the high FDV, low float token model presents new opportunities for funding and growth, it also necessitates a renewed focus on investor protection and market stability. The path forward will likely require a collective effort among developers, investors, and regulators to craft a funding landscape that preserves the benefits of early crypto models while addressing their shortcomings. The sustainability of this new paradigm will depend on its ability to adapt to the complex dynamics of an ever-evolving market.