The crypto market posted a modest gain this week, with total market cap up +0.6%, while Bitcoin touched $106,000 late Sunday before pulling back slightly. Price action has been largely range-bound between $101K and $106K, with markets eyeing a break of the upper boundary as a signal for a renewed push toward the all-time high of $109,000.

The risk remains of a local top forming, particularly if broader market risk sentiment continues to deteriorate. Despite Bitcoin’s proximity to record levels, market breadth remains narrow. The total crypto market cap excluding stablecoins continues to lag a divergence that reflects hesitation across risk assets, not just in crypto, but across global markets.

As we highlighted in the February 10 edition of The Insider:

“The market has already tested 2025 lows, with potential further drawdowns to mid-euphoria post-election. If those are broken, it opens up for pre-election levels. These levels align with historical support zones and could present significant accumulation opportunities if reached.”

That analysis played out with precision: the market bottomed almost exactly at pre-election support, completing a full re-tracement of the November euphoria. Yet the recovery has been uneven, with total market cap ex-stables struggling to reclaim the $3 trillion mark with conviction. Bitcoin has led, but many altcoins remain well off their highs a divergence that could soon resolve, one way or the other.

Macro: Downgrades & US Rates

The macro backdrop turned decisively more fragile this week. On Friday, May 16, Moody’s downgraded U.S. sovereign credit from Aaa to Aa1, citing unsustainable fiscal deficits, a $36 trillion debt burden, and elevated interest payments. The downgrade coincided with a move higher in long-dated Treasury yields, with the 10-year at 4.526% and 30-year at 4.966%, both sitting near cycle highs.

This yield surge poses a direct challenge to risk assets, including crypto. Historically, rising real yields have pressured valuations across equities and digital assets, and Bitcoin has not been immune. The first time in 2025, 30-year yields reached these levels, Bitcoin was trading near $100K, followed by a swift and disorderly correction. The second time President trump put a pause on tarrifs to cool down markets. Will BTC be a hedge for potential future monetary experiments this time?

Adding to this pressure is a sharp repricing in rate expectations. As of this week, markets now assign a 91.7% probability that the Fed holds rates steady at 4.25–4.50% at the June FOMC meeting up from 55.0% just two weeks ago.

The likelihood of a near-term rate cut has effectively collapsed, with markets now bracing for an extended pause. This shift tightens financial conditions at the margin and reduces the prospect of monetary relief in the short term a notable shift for crypto, which has recently tracked liquidity conditions closely.

There’s growing speculation that President Trump may intervene, as he has in the past, to stabilise markets. Potential responses include:

Adjusting tariff policy to ease inflation expectations and bring down yields.

Pressuring the Federal Reserve to pivot dovish through public rhetoric.

Unveiling fiscal stimulus, including targeted tax cuts or deregulation, aimed at supporting consumer sentiment and market confidence.

In short, the U.S. is walking a fine line between credibility and growth and crypto, as a high-beta macro asset, is deeply sensitive to how that balance evolves.

Liquidity: Tracking the Lag

As we highlighted last week, total crypto market is continuing to follow the global liquidity with a 90d lag and if relationship continues should reach back to all time high in early-mid June.

One of the more striking dynamics continues to be the relationship between Ethereum (ETH) and US net liquidity.

Net liquidity = Federal Balance Sheet - Treasury General Account - Reverse Repo

The chart shows ETH/USD tracking net liquidity (black line) with a five-week lag. Historically, liquidity has been a reliable leading indicator of ETH’s direction.

The only deviation was the post election rally, when market went into full euphoria mode but came back quickly thereafter. With net liquidity now rolling over, Ethereum may face headwinds in the near term unless monetary or fiscal support resumes.

On a more positive note, ETF flows remain constructive: BTC products saw +$608M in net inflows last week, while ETH ETFs added $41.8M. It marks the fourth consecutive week of net inflows for both assets, a streak not seen at any point earlier this year

Altcoins: The End of the Rising Tide

Altcoins are no longer moving as a single bloc. Over the past several weeks, we’ve observed a persistent divergence between altcoin market cap and altcoin dominance, a signal that supports our long-standing view: the “rising tide lifts all boats” dynamic that once defined earlier crypto cycles is now firmly behind us.

The ratio of TOTAL3 (altcoin market cap excluding BTC & ETH and stablecoins) to TOTAL has continued to decline, even as absolute valuations across the space have modestly recovered. This divergence points to growing concentration in flows, capital is rotating into select pockets of the market, not the sector as a whole.

That view is reinforced when looking at post-liberation day performance. Since the April bottom, micro caps ($100M–$500M) have been the standout performers, outpacing both mid caps and large caps. This surge in lower-tier names suggests that the market is hunting asymmetry, often favouring under-the-radar narratives or early-stage tokens over established protocols.

Zooming out to a 90-day performance window, relative to BTC, the trend is even more apparent. A small cluster of assets, notably Euler, have posted outsized gains, while the broader altcoin complex has underperformed. In fact, across the top 100 assets, the vast majority are flat-to-negative against BTC. This is a classic sign of dispersion performance is concentrated, not systemic.

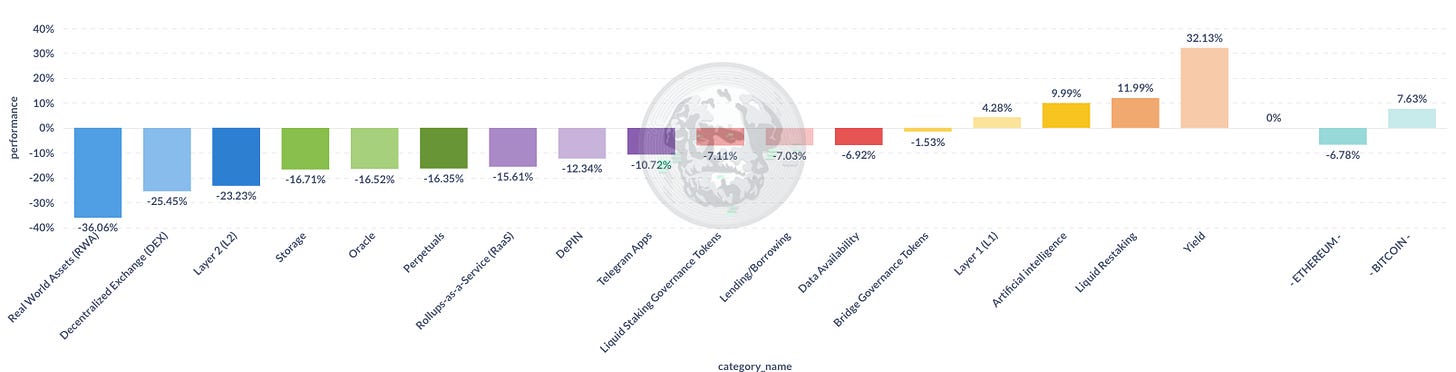

Sector-specific breakdowns add another layer of context:

RWAs, DEXs, and L2s have materially underperformed, some down as much as 25–35% over the last 90 days.

Ethereum is down -6.78%, while Bitcoin is up +7.63%, extending the dominance gap.

The only categories with sustained strength are yield-bearing tokens (+32%), liquid restaking (+12%), and AI-linked projects (+10%) all narratives with structural or speculative momentum.

In other words, capital is no longer passive. It is increasingly narrative-driven, thesis-led, and selective. The days of indiscriminate altcoin rallies appear to be over. Performance is being driven by credibility, capital efficiency, and innovation, not by proximity to BTC.

This shift has significant implications for portfolio construction. Passive exposure to the “altcoin beta” bucket is no longer sufficient. Selectivity, sector insight, and early entry into emerging primitives are becoming the prerequisites for outperformance.

The altcoin market hasn’t disappeared , it’s just evolved. And in this new phase, precision matters far more than participation.

Looking Ahead

While macro conditions remain fragile and some liquidity trends are beginning to roll over we continue to expect short term volatility. However, a potential upside catalyst is emerging, the pending passage of the GENIUS Act, the U.S. Senate’s stablecoin regulation bill, expected as early as next week.

If the Senate achieves 60 votes for cloture, final passage becomes highly likely. The House would then need to approve its version before the bill is signed into law.

We estimate the probability of full enactment at 70%, contingent on today’s Senate vote. Passage would not only bring long-overdue regulatory clarity to a $243B+ stablecoin market, but also position the U.S. to anchor digital dollars more deeply into the global financial system, potentially reinforcing both capital flows and dollar dominance in digital markets.

With market breadth still narrow and macro risk elevated, regulatory clarity not just monetary easing may be the unlock for broader participation and renewed medium- to long-term momentum across the crypto asset class. Passage of GENIUS could also create political space for additional crypto legislation; failure would likely close that window.