The Fat Participation Thesis

Why the Future Belongs to Active Participants, Not Just Protocols or Applications

Key Takeaways

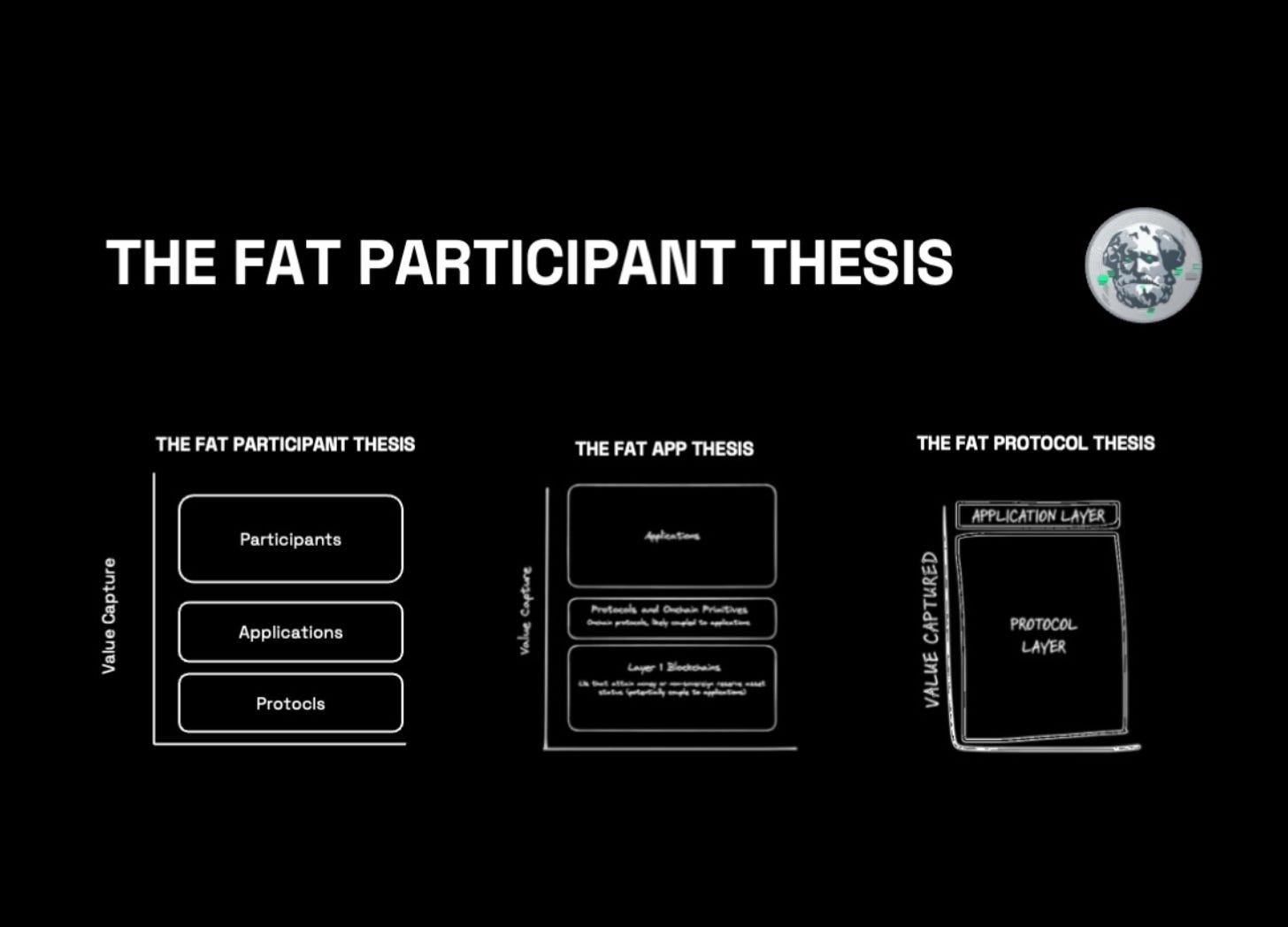

Participant-Centric Value: The Fat Participant Thesis proposes that the majority of value in Web3 will accrue to active participants (users, developers, infrastructure providers), rather than solely to protocols or applications.

Symbiotic User-Infrastructure Relationship: It emphasizes the crucial interdependence between users and infrastructure in the Web3 ecosystem, where user empowerment and infrastructure value are directly linked.

Beyond Protocol and Application: Unlike previous models, this thesis focuses on the human layer as the primary value driver, challenging projects to align interests across all participant types.

Adaptive and Interoperable Ecosystems: Successful Web3 projects will need to create systems that fairly distribute value, adapt to user needs, and enable seamless movement between different blockchain ecosystems.

Call to Action: The Fat Participant Thesis challenges the crypto industry to build more user-centric and participatory systems, fundamentally reshaping how value is created and distributed in Web3.

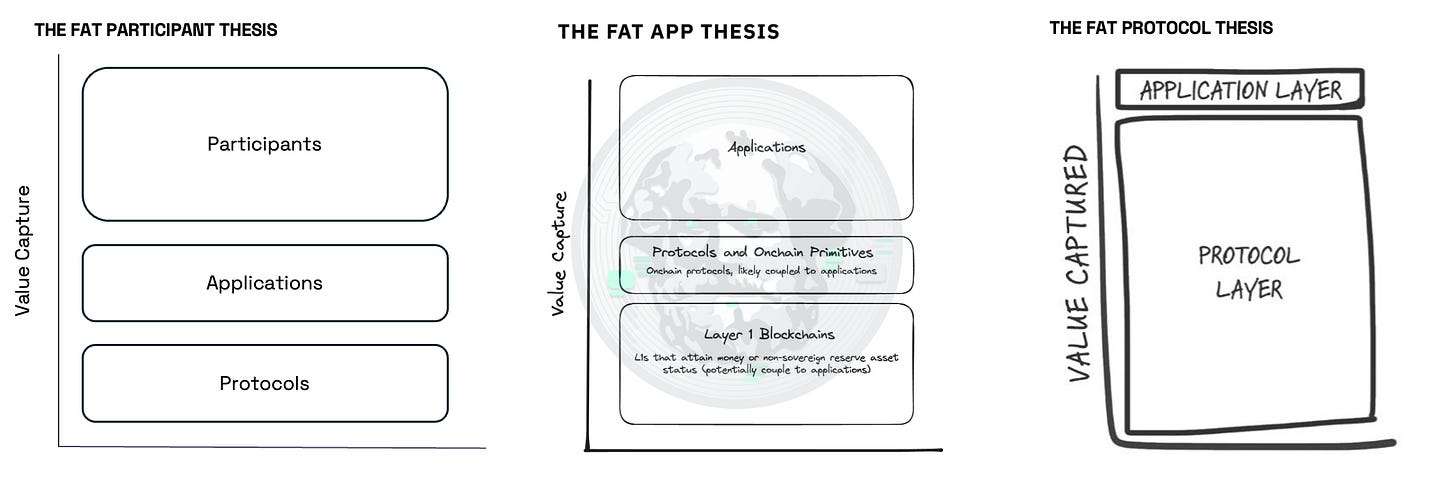

In the ever-evolving landscape of blockchain and cryptocurrency, one question has persistently captivated investors, developers, and enthusiasts alike: Where does the value accrue in this new digital economy? Over the past decade, we've witnessed a fascinating shift in thinking about this crucial question, moving from the "Fat Protocol Thesis" to the "Fat App Thesis." But what if both of these models are overlooking the most critical element of the Web3 ecosystem – the participants themselves?

In this article, we'll explore the evolution of value capture theories in the crypto space, introduce the concept of a "Fat Participants Thesis," and discuss why the future of Web3 might depend on putting users at the centre of our value models. We'll also delve into the intricacies of blockspace, Maximal Extractable Value (MEV), and emerging solutions that aim to redistribute value back to protocols and users.

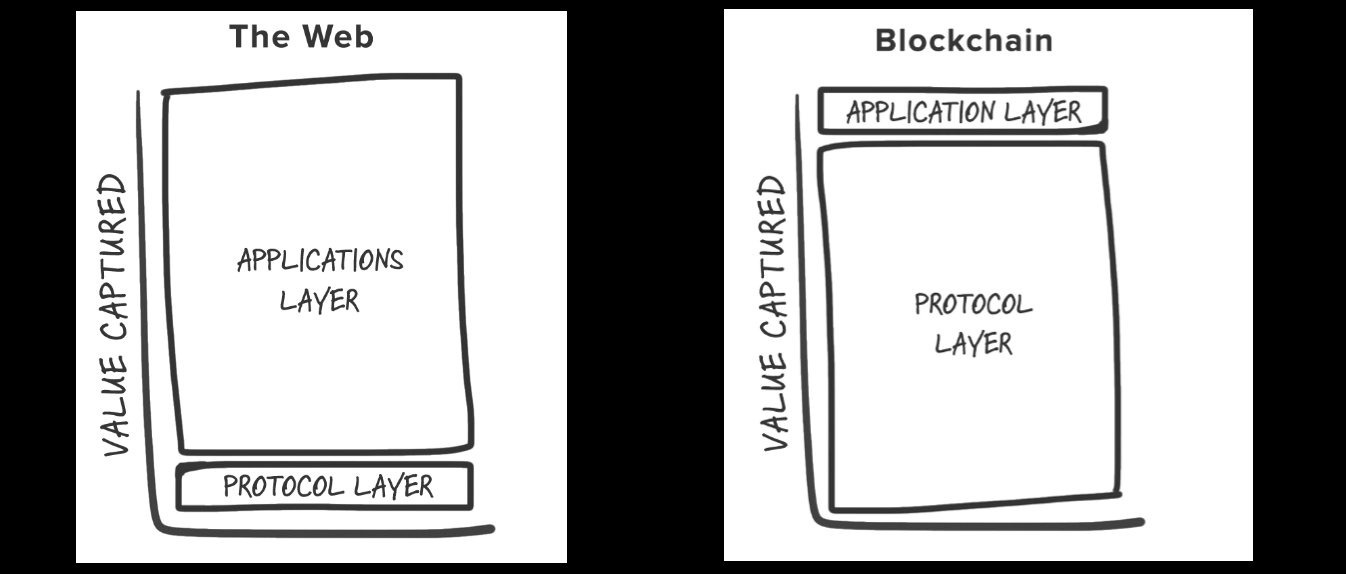

The Fat Protocol Thesis

In 2016, Joel Monegro introduced the crypto world to the Fat Protocol Thesis. This influential idea posited that in the blockchain ecosystem, unlike the traditional internet, the majority of value would accrue at the protocol layer rather than the application layer.

The argument was compelling: As more decentralised applications (dApps) are built on blockchain platforms, the network effects and demand for the protocol's native tokens increase, driving up their value. This dynamic represented a reversal of how value is captured in traditional internet models, where applications like Facebook capture most of the value while the underlying protocols (such as TCP/IP) capture very little.

Monegro's thesis was supported by several key points:

Shared Data Layer: Blockchains provide a shared, open data layer that all applications can access and build upon. This fosters innovation and competition at the application layer while concentrating value at the protocol level.

Token Appreciation Flywheel: As tokens appreciate in value, they attract more speculators, some of whom become users. This increased user base attracts more developers, creating a positive feedback loop that further drives token value.

Interoperability: The open nature of blockchain protocols allows for greater interoperability between applications, further reinforcing the value of the underlying protocol.

For years, this thesis seemed to hold true. We saw explosive growth in the value of protocol tokens like Ethereum (ETH), while many applications struggled to capture significant value. The market capitalisation of major blockchain protocols dwarfed that of even the most successful dApps built on top of them.

The Shift to Fat App Thesis

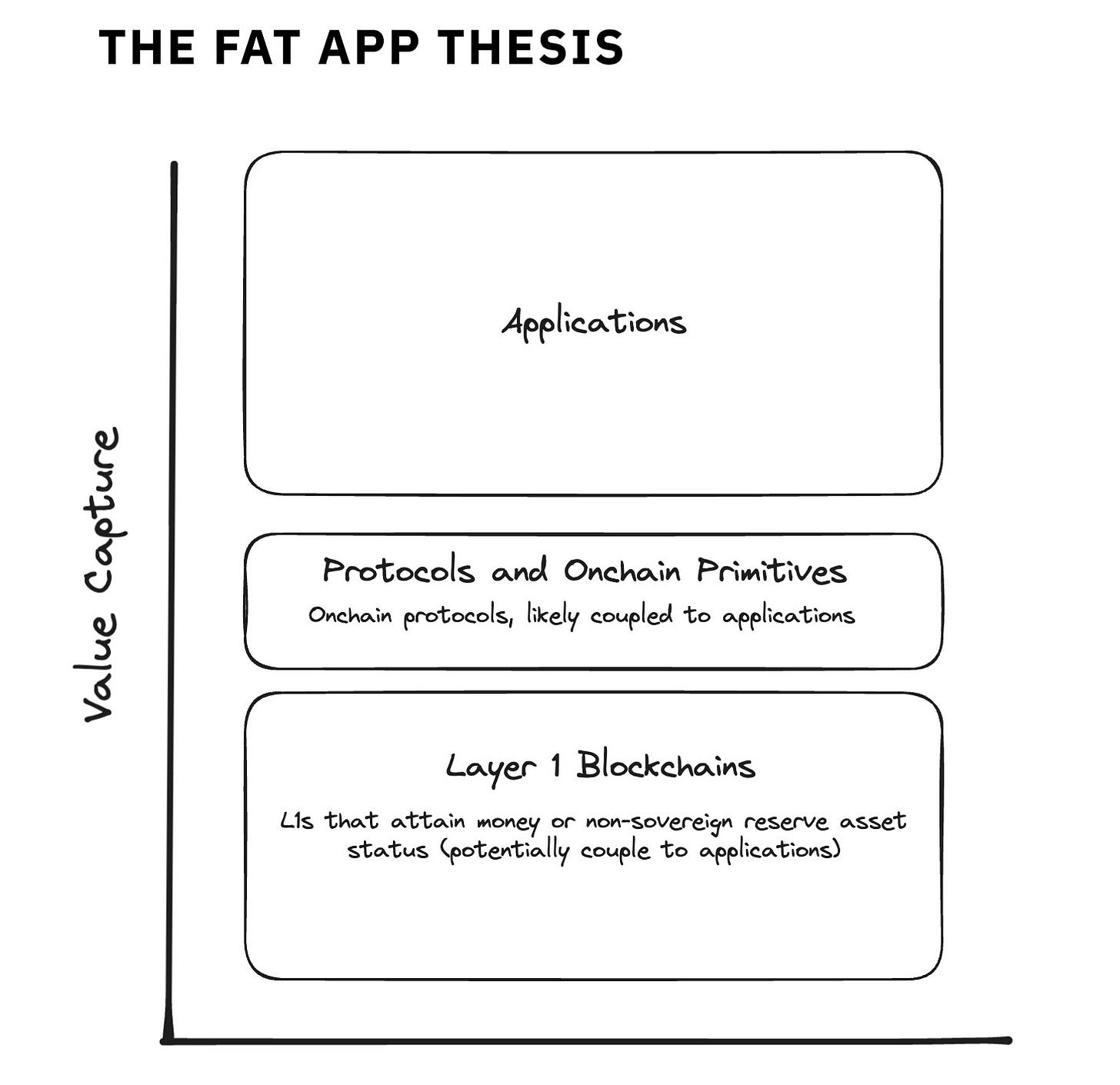

However, as the crypto ecosystem matured, cracks began to appear in the Fat Protocol Thesis. Critics, including notable voices like Mason Nystrom at Pantera Capital, began to argue that value would eventually concentrate at the application layer.

The Fat App Thesis contends that dApps can extract significant value by:

Focusing on specific use cases

Building deep moats around these use cases (e.g., liquidity, user experience, brand)

Gaining a loyal following

Several factors contribute to this shift in thinking:

I. Commoditisation of Blockspace

Blockchains, at their core, sell blockspace. This space becomes more valuable when applications run on top of it, creating demand for transactions and computations. However, the proliferation of new Layer 1 and Layer 2 solutions has led to an abundance of blockspace, potentially reducing its scarcity and value.

II. Modularisation of Base Layers

The trend towards modular blockchain architectures has fragmented the value proposition of base layers. With separate layers for execution, settlement, data availability, and consensus, it becomes more challenging to concentrate value in a single protocol token.

III. Chain Abstraction

The push towards a "chain-abstracted" future, where users interact with applications without needing to know the underlying blockchain, could potentially shift value capture from protocols to user-facing applications.

IV. Application-Specific Innovations

Some applications have developed unique features or network effects that are difficult to replicate, creating moats that allow them to capture more value. Examples include:

Uniswap: The leading decentralised exchange has generated hundreds of millions in fees and built a strong brand, demonstrating the potential for applications to capture substantial value.

Application-Specific Blockchains: Some apps have decided to build their own blockchains, further blurring the lines between protocols and apps.

MEV Capture Mechanisms: Innovative applications are finding ways to capture and redistribute Miner Extractable Value (MEV), a form of value that traditionally accrued to miners or validators.

The MEV Ecosystem: Challenges and Emerging Solutions

MEV is the surplus value extracted from blockchain systems. As long as there is value transacting through permissionless systems, there is MEV

Maximal Extractable Value (MEV) has emerged as a significant factor in the blockchain value ecosystem, representing the maximum value that can be extracted from block production beyond standard block rewards and gas fees. While MEV can be profitable for miners and validators, it often leads to value leakage from protocols and users, creating misaligned incentives within the ecosystem.

As awareness of MEV has grown, efforts to mitigate its negative effects and redistribute its value have proliferated. These solutions span a spectrum from user protection to protocol-level value capture:

User-Centric Solutions:

Protect users from MEV through mechanisms like batch auctions and transaction shielding. Example: CoW Swap

Searcher and Builder Focused:

Create efficient marketplaces for MEV extraction and mitigate harmful practices. Example: Flashbots Auction

Protocol-Level Solutions:

Capture and redistribute MEV at the protocol level. Example: Osmosis "MEV Burn"

Oracle-Specific MEV (OEV) Solutions:

Address the unique challenges of MEV in oracle updates and price feeds. Example: UMA's Oval

Blockchain-Level Approaches:

Implement innovative transaction ordering mechanisms to democratize MEV extraction and reduce its negative impacts. Example: Arbitrum's Timeboost proposal

These varied approaches highlight the complexity of the MEV challenge and the diverse strategies employed to address it. Solutions like Oval represent a significant step towards aligning the interests of protocols, applications, and users. By capturing and redistributing MEV, particularly at the protocol level, these tools could potentially increase value accrual to both protocols and applications, challenging the traditional Fat Protocol vs. Fat App dichotomy.

The focus on Oracle Extractable Value (OEV) underscores the specific challenges faced by DeFi protocols reliant on price feeds. Solutions targeting OEV are particularly crucial for lending protocols and other DeFi applications that heavily depend on accurate and timely price information.

The Fat Participant Thesis

As the crypto landscape evolves beyond the traditional Fat Protocol vs. Fat App debate, a new concept emerges that promises to reshape our understanding of value distribution in the Web3 ecosystem. Enter "The Fat Participant Thesis" – a perspective that places the ecosystem's active participants, both users and infrastructure providers, at the centre of value creation and capture.

The Symbiosis of Users and Infrastructure

At the heart of the Fat Participant Thesis lies a crucial understanding: the true value in the Web3 ecosystem emerges from the symbiotic relationship between users and infrastructure. This relationship fundamentally reshapes how we think about value accrual in the digital age.

The current crypto landscape, with its focus on early adopters and institutional players, risks stagnation by failing to continuously incentivise new and existing participants. To fuel the next wave of crypto adoption, we need a fundamental shift in how we perceive and distribute value within the Web3 space.

Users: The Lifeblood of the Ecosystem

Users in the Web3 space possess a unique power: the ability to transact and interact without being tethered to any single infrastructure. Thanks to innovations in interoperability and user-sovereign identity solutions, users can seamlessly move their assets, data, and activities across different protocols and applications. This fluidity gives users unprecedented leverage and makes them the primary value drivers in the ecosystem.

Key aspects of user empowerment include:

Asset Portability: Users can move their digital assets across different blockchains and applications with increasing ease.

Identity Sovereignty: Self-sovereign identity solutions allow users to maintain control over their personal data and credentials.

Choice of Infrastructure: Users can select which networks or protocols to use based on their specific needs and preferences.

Infrastructure: The Backbone That Needs Its Users

On the flip side, infrastructure providers – such as validators, miners, or node operators – find themselves in a position where their value is directly tied to user activity. Without active users, even the most technologically advanced blockchain infrastructure becomes essentially worthless.

Consider the following:

Validation Without Transactions: Validators on a blockchain with no user transactions are merely running expensive equipment with no purpose.

Security Through Usage: The security of many blockchain networks increases with more user activity and higher stakes, creating a virtuous cycle of usage and security.

Economic Incentives: The economic rewards for infrastructure providers (e.g., transaction fees, block rewards) are directly tied to user activity on the network.

This dynamic creates a powerful incentive for infrastructure providers to cater to user needs and continually improve their offerings to attract and retain active participants.

The New Paradigm: Value Flows to Participants

The Fat Participant Thesis argues that in this ecosystem, where users have the freedom to choose and infrastructure depends on usage, the majority of value will ultimately accrue to active participants. This includes not just end-users, but also developers, content creators, and yes, infrastructure providers who actively contribute to the ecosystem's growth and functionality.

This shift in value distribution is driven by several key factors:

User Empowerment: As users gain more control over their digital assets and identities, they can more easily direct value flows towards platforms and services that best meet their needs.

Infrastructure Competitiveness: With users able to easily switch between different protocols and networks, infrastructure providers must constantly innovate and improve to attract and retain participants.

Network Effects 2.0: Unlike traditional network effects that lock users into specific platforms, Web3 network effects are more fluid and user-centric. Value accrues to networks with the most engaged and active participants, not necessarily the largest user base.

Alignment of Incentives: Successful Web3 projects will be those that effectively align the interests of all participants - users, developers, and infrastructure providers alike.

Value Creation at the Edges: In a decentralised ecosystem, value is increasingly created at the edges by active participants rather than captured by central entities.

Furthermore, the potential emergence of a user-centric aggregation layer could significantly amplify these factors. This layer would act as an intelligent guide for capital flows within the ecosystem, similar to how Google directs web traffic, but with a crucial difference: the value accrues to the users. By providing easy access to information about the best incentives across various protocols and services, these aggregators would empower users to optimize their participation and capital allocation. Users could effortlessly move their assets to wherever they receive the best value, further driving competition and innovation among protocols and services. This development would not only reinforce user empowerment but also intensify the need for infrastructure competitiveness and incentive alignment, ultimately accelerating the shift towards a truly participant-centric Web3 ecosystem.

Implementing the Fat Participant Thesis

To realise this participant-centric vision, the Web3 ecosystem must evolve across several dimensions:

Participatory Economics: Future protocols and applications should incorporate economic models that reward active participation. These could include:

Dynamic fee-sharing mechanisms that distribute value to both users and infrastructure providers based on their contributions.

Governance systems that give all types of participants a meaningful voice in protocol direction.

Tiered benefit structures that incentivise long-term engagement and value creation.

Seamless Interoperability: As the boundaries between different blockchain ecosystems blur, participants will benefit from increased optionality and efficiency. Protocols and infrastructure providers that embrace this interconnected future will be best positioned to attract and retain active participants.

Positive-Sum MEV: Rather than viewing MEV as a zero-sum game, forward-thinking projects will leverage it as a tool for participant empowerment. By capturing and equitably redistributing MEV, protocols can enhance the experience for all participants through lower costs, increased efficiency, and direct rewards.

Participant Empowerment through Education: For individuals to fully capitalize on the opportunities in the Web3 space, they need to be equipped with the right knowledge and tools. This includes educating users about the value of their participation and helping infrastructure providers understand the importance of user-centric design.

Conclusion

The Fat Participant Thesis represents a fundamental shift in how we understand value creation and distribution in the Web3 space. By recognising the crucial interdependence between users and infrastructure, and the unique power held by participants in this ecosystem, we can create more equitable, efficient, and user-centric systems.

Unlike the Fat Protocol Thesis, which posits that the majority of value accrues to the underlying blockchain protocols, or the Fat Application Thesis, which argues that value concentrates in the applications built on top of these protocols, the Fat Participant Thesis proposes a more distributed model of value capture. It recognises that without active and engaged participants—both users and infrastructure providers—neither protocols nor applications can sustain value. This thesis shifts the focus from the technology layer (protocols) or the service layer (applications) to the human layer (participants) as the primary value driver and beneficiary in the Web3 ecosystem.

As we move forward, protocols, applications, and infrastructure providers must adapt to this new reality. Those who can effectively align their interests with their participants, create mechanisms for equitable value distribution, and leverage the symbiotic relationship between users and infrastructure will be the ones who thrive in the next phase of the Web3 revolution.

The Fat Participant Thesis isn't just a prediction; it's a call to action. It's time for the crypto industry to fully embrace the power of its participants – both users and infrastructure providers – and build systems that reflect this new paradigm. Only then can we unlock the full potential of Web3 and create a digital economy that truly benefits everyone involved.