Executive Summary

The cryptocurrency market stands at a pivotal moment in its evolution, transitioning from speculative exuberance to sustainable value creation. We're witnessing a fundamental shift in how value is created, captured, and distributed in digital assets, driven by the emergence of liquid funds as sophisticated market participants and increasing institutional adoption. This transformation is marked by three distinct eras: the democratic but chaotic ICO boom, the professionalizing but exclusionary VC dominance, and now the emergence of fundamental liquid funds as crucial market makers and value arbiters.

This report examines how the market is evolving beyond pure narrative-driven speculation toward fundamental value creation. As regulatory clarity emerges and institutional adoption increases, we anticipate this transition will accelerate, creating opportunities for investors who can identify and evaluate sustainable value creation mechanisms.

The Evolution of Value Creation

The Core Question: Why Own a Crypto Asset?

Every sound investment thesis begins with a fundamental question: Why would someone want to hold this asset for the long term?

In traditional markets, the answer lies in tangible benefits—dividends from stocks, interest from bonds, or rental income from real estate—forming a baseline of value independent of speculation.

In the cryptocurrency ecosystem, value creation diverges from these traditional models but retains a similar underlying logic. Blockchain protocols offer innovative mechanisms to generate and distribute value, such as staking rewards, fee-sharing models, token buybacks, and governance rights over treasury assets. These tools create a new paradigm for aligning incentives and capturing value in decentralised systems.

Reinvesting Growth vs. Immediate Returns

Not all value is realised immediately. Many crypto protocols adopt strategies reminiscent of early-stage startups, prioritising growth over distributions. Examples include:

Reinvestment in Development: Early-stage protocols focus on scaling operations, enhancing infrastructure, and acquiring users.

Fee Switches: Some protocols reserve the option to share fees with token holders, activating these mechanisms only after reaching operational maturity.

Hybrid Approaches: Combining growth-focused reinvestment with occasional distributions, allowing protocols to adapt as they scale.

The success of these strategies depends on a clearly defined thesis for how reinvestment or delayed returns will ultimately benefit token holders. The key isn’t the mechanism itself but the robustness of the rationale behind it.

From Speculation to Substance

In its nascent stages, the crypto market relied heavily on speculative narratives to drive valuations. Tokens were priced based on hype and momentum, with minimal consideration of underlying fundamentals. This model, while effective during periods of exuberance, often led to misaligned incentives and unsustainable growth.

The market is now shifting toward substance. Liquid funds and other institutional investors are developing structured valuation frameworks that assess protocols based on:

Market Size and Potential: What proportion of the market can the protocol realistically capture?

Revenue and Growth Trajectories: Are revenue streams sustainable, and how are they expected to evolve?

Competitive Moats: What differentiates the protocol from others, and how defensible are these advantages?

Network Effects: Can the protocol scale effectively, and does its value grow with increased participation?

Tokenomics and Alignment: Does the token design align incentives across stakeholders?

This marks a departure from speculative cycles, ushering in an era of disciplined, data-driven investment.

A Tale of Two Cycles

The crypto market's evolution toward fundamental value creation has been shaped by two distinct eras, each leaving important lessons about sustainable market structures and value capture. Understanding this history is crucial for appreciating why liquid funds and fundamental analysis represent the natural next stage in market evolution.

The ICO Boom (2017-2018)

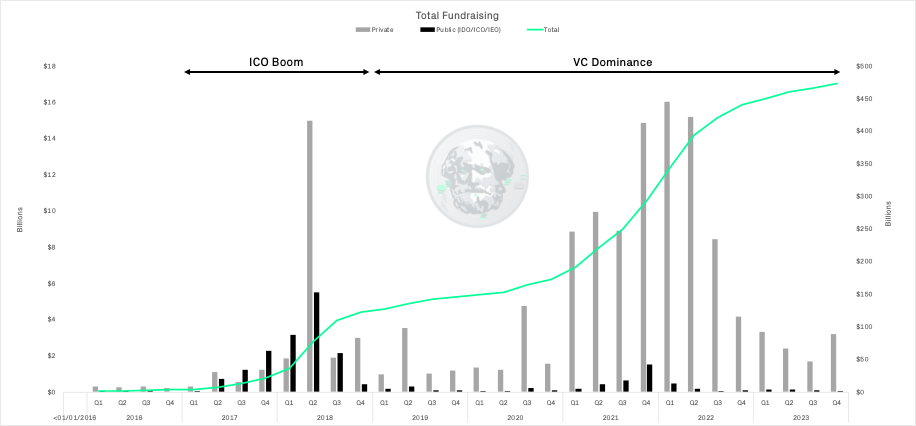

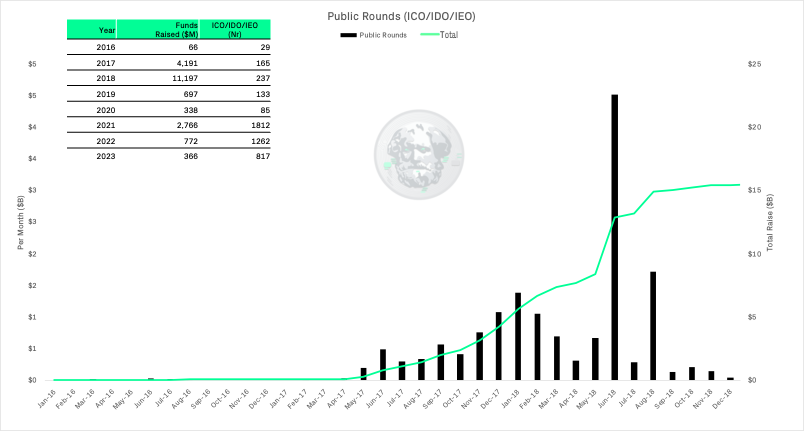

The Initial Coin Offering boom marked cryptocurrency's first major experiment in democratising early-stage investment. During this period, projects raised over $20 billion through token sales, promising to revolutionise startup funding by allowing retail investors to participate in early-stage opportunities alongside institutions. The model offered unprecedented accessibility, but ultimately proved unsustainable due to fundamental structural flaws.

At its core, the ICO model suffered from severe misalignment of incentives. Without vesting periods for founding teams, many projects faced immediate selling pressure upon listing. The absence of traditional oversight mechanisms meant founders could abandon projects after raising funds, leading to a proliferation of projects with sophisticated white papers but little substance. Data from the period reveals that over 80% of ICOs launched in 2017 exhibited characteristics of fraudulent activity.

More fundamentally, the ICO era highlighted the dangers of separating fundraising from value creation mechanisms. While traditional equity links investor returns to business success, most ICO tokens lacked clear connections between protocol success and token value. By early 2019, regulatory intervention effectively ended the ICO era, but not before establishing important lessons about the need for aligned incentives and sustainable value capture mechanisms

The VC Dominance Era (2019-2023)

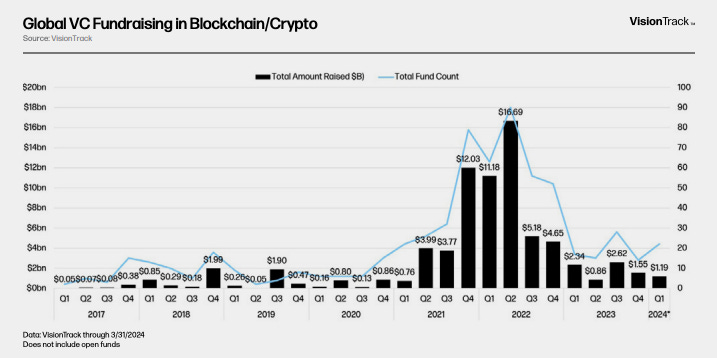

The venture capital era that followed brought needed professionalisation to the space but introduced its own set of market distortions. Private funding rounds grew from minimal activity in 2017 to peak at over $16 billion quarterly in 2022, with cumulative investment exceeding $400 billion.

Global VC fundraising in blockchain/crypto reached unprecedented levels, and the intense competition for deals among these well-capitalised funds led to significant market distortions.

The High FDV, Low Float Model

This environment created a distinctive market structure:

Projects would launch with less than 5% of their total token supply in circulation

Fully diluted valuations routinely reached billions of dollars despite minimal traction

Extended vesting schedules spanning multiple years became normal

Retail investors were effectively priced out of meaningful participation

For example, a project launching with a $5 billion FDV and 3% initial circulation required investors to believe in a $150 million day-one market cap just to break even.

Market Impact

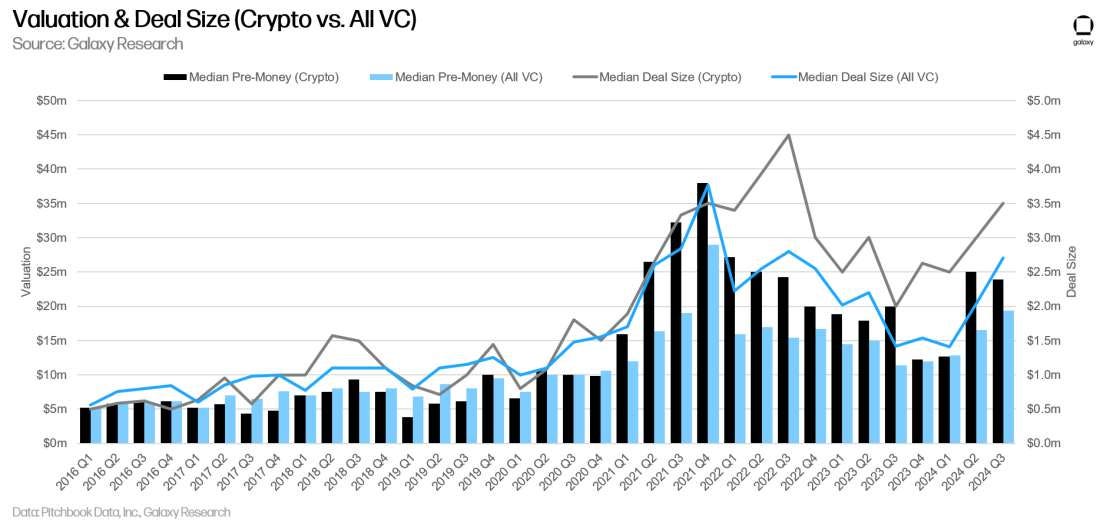

The impact on valuations was particularly striking:

Median pre-money valuations in crypto consistently exceeded those in traditional venture capital

Deal sizes grew to unprecedented levels, with median investments reaching as high as $45 million in late 2021

Valuations far exceeded comparable stages in traditional technology investing

The Market Divide

Both eras revealed fundamental limitations in their approaches to value creation and capture. The ICO model's lack of accountability and governance led to widespread abuse, while the VC model's focus on narrative-driven growth and marked-up private rounds proved poorly suited for an asset class that requires active management and dynamic pricing.

The VC model's limitations become particularly evident during token unlocks, when venture capitalists – constrained by fund structures and return requirements – often become forced sellers into markets without sufficient fundamental demand. The traditional VC approach of holding for 7-10 years until an IPO doesn't translate well to liquid tokens, where marking to market happens daily and selling pressure can materialise well before projects achieve product-market fit.

The Resulting Market Structure

These experiences have created a bifurcated market:

Retail investors, burned by both cycles, have largely retreated to memecoins where they feel they can compete on more equal terms

Venture-backed protocols struggle to balance private investor expectations with public market realities, often finding their high initial valuations make it challenging to generate sufficient return potential for public market participants

This history sets the stage for the emergence of liquid funds as a crucial bridge between private and public markets. The market needs mechanisms to close the growing gap between early-stage investment and sustainable value creation – a role that liquid funds are uniquely positioned to fill.

The Ascent of Liquid Funds

From Beta Selection to Fundamental Analysis

The story of liquid crypto funds reflects the broader maturation of digital asset markets. The earliest funds, emerging around 2013, operated primarily as asset allocators in a nascent market. With an investment universe limited to Bitcoin and a handful of alternative cryptocurrencies, these pioneers focused mainly on market timing and portfolio weighting decisions. Success largely depended on capturing directional market moves rather than fundamental analysis.

A decade later, the landscape has transformed dramatically. The expansion of DeFi and the emergence of revenue-generating protocols has created opportunities for a fundamentally different investment approach. Modern liquid funds are increasingly resembling sophisticated investment managers in traditional markets, but with unique capabilities suited to the digital asset space.

The New Generation of Liquid Funds

Today's leading liquid funds bear little resemblance to their predecessors. Rather than trying to time market cycles or allocate across a broad basket of assets, these funds:

Build concentrated positions based on fundamental analysis

Actively participate in protocol governance and development

Develop sophisticated frameworks for valuing different value capture mechanisms

Combine traditional financial analysis with crypto-native metrics

This evolution has been enabled by the maturing protocol landscape. The implementation of fee switches, emergence of sustainable revenue models, and development of various value capture mechanisms provides a rich opportunity set for fundamental investing that simply didn't exist in the market's early days.

Bridging Critical Market Gaps

Liquid funds are uniquely positioned to bridge several fundamental gaps that have historically created inefficiencies:

Between Private and Public Markets: The transition from private to public markets has traditionally been a point of significant volatility and value destruction. Liquid funds help create more orderly markets during token unlocks and transitions, while working with protocols to develop sustainable distribution strategies.

Between Retail and Institutional Investors: By developing sophisticated but transparent valuation frameworks, liquid funds help reduce information asymmetries that have historically disadvantaged retail investors. Their active market participation creates better price discovery and more efficient markets for all participants.

Between Growth and Value: Liquid funds help protocols navigate the balance between reinvesting in growth and providing value to token holders. Their ability to model different approaches to value creation helps projects make informed decisions about capital allocation and tokenomics.

Fund Structure & Performance

The distinction between fund structures in crypto markets has become increasingly significant. Traditional venture capital funds, which dominate the space in terms of number and assets under management, typically operate as closed-end vehicles with fixed investment periods. Data shows that venture funds raised over $30 billion in 2021-2022, vastly exceeding the approximately $5 billion raised by liquid funds during the same period.

Performance Across Market Cycles

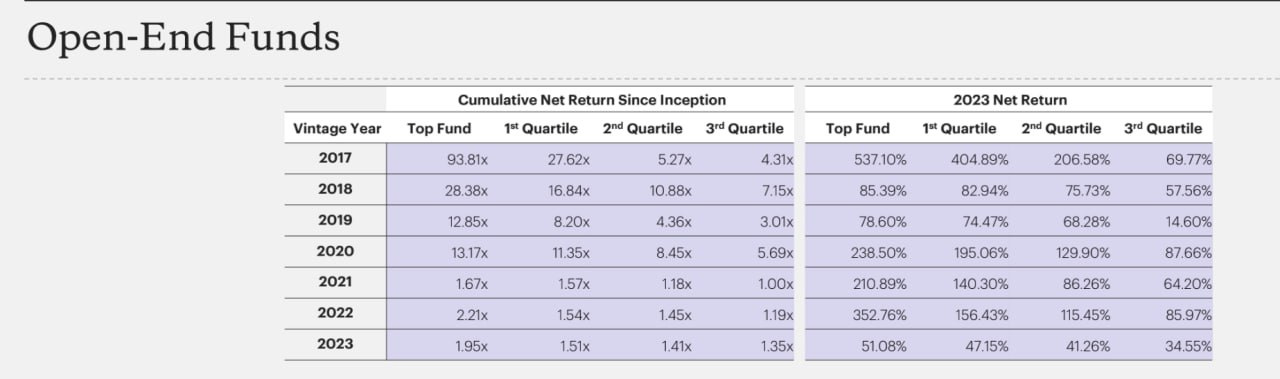

The data reveals a compelling performance difference between fund structures in crypto markets, particularly between liquid funds (typically open-ended, and many with longer-hold sidecar investment vehicles) and venture capital funds (typically closed-ended).

Liquid funds, operating through open-ended structures, have demonstrated remarkable consistency across market cycles. This structure allows investors to subscribe and redeem at regular intervals, forcing managers to maintain robust risk management and liquidity provisions. The top performers have achieved returns ranging from 93x since 2017 to 1.95x in 2023, with strong performance even during challenging market conditions. Most notably, these funds maintained positive performance through the 2022 downturn, with top funds achieving >300% returns.

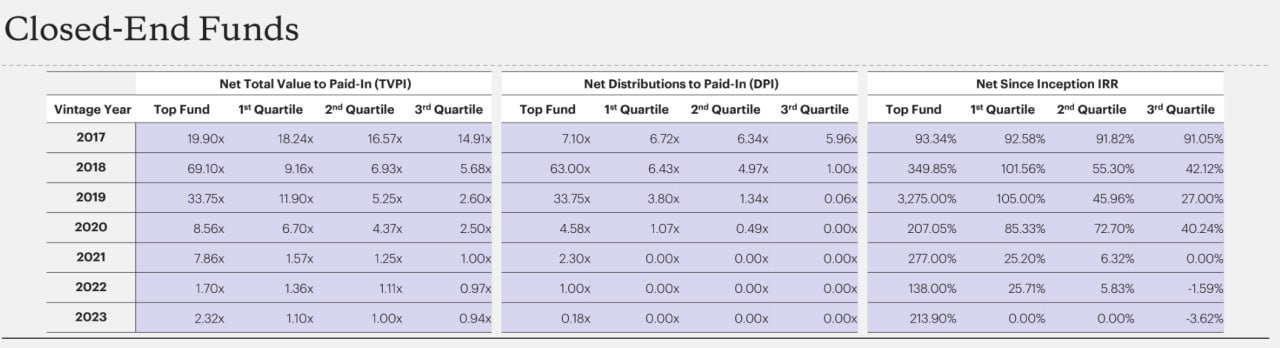

Venture capital funds, typically structured as closed-end vehicles with 7-10 year terms, face different dynamics. While showing strong IRRs in early vintages, they've encountered greater challenges in recent years. The data shows declining distributions to paid-in capital (DPI) ratios, particularly from 2021 onwards. This structure, while beneficial for long-term private investments, can create challenges in crypto markets where opportunities require more dynamic capital deployment and exit timing.

This performance divergence reflects the fundamental differences in how these funds operate. During the 2021-2022 bull market, when massive capital inflows lifted all assets, the structural differences mattered less. However, today's market environment particularly rewards the flexibility and active management capabilities typically associated with liquid funds:

Ability to time entry and exit

Dynamic position sizing

Active protocol engagement

Maintenance of strategic reserves

Sophisticated risk management

Market Cycles and Structural Advantages

Cryptocurrency markets exhibit a distinct cyclical pattern, oscillating between bull and bear phases. This ebb and flow creates opportunities and challenges for different investment strategies.

During bull markets, liquid crypto assets like major cryptocurrencies tend to outperform VC investments. The broad optimism allows liquid holdings to generate substantial gains, though they also experience sharper drawdowns when the market turns bearish.

Conversely, VC investments in crypto startups can capitalize on bull market exuberance to secure the best deals and outsized returns. Yet, the full realisation of these VC gains may not align with the peak of the bull run due to vesting periods, and not all VC investments would have made it through to that point.

When the market shifts to a bear phase, the dynamic changes. Liquid crypto assets suffer deeper drawdowns and outflows, while VC investments demonstrate more resilience. VC funds may even be able to outperform liquid counterparts during these downturns, as they are able to strike better deals with crypto startups in need of funding at more compressed valuations.

This interplay between liquid crypto assets and VC investments highlights the importance of understanding the broader market cycle and aligning investment strategies accordingly.

The Hybrid Advantage

A hybrid approach, combining elements of both venture capital and liquid fund structures, offers unique advantages in navigating these market cycles. Key benefits include are strategic flexibility:

Early-stage private investment capabilities

Active management of public positions

Ability to maintain significant cash positions during downturns

Opportunistic deployment across market cycles

The venture component enables participation in private rounds and early protocol development, while liquid markets capabilities allow for dynamic position management and risk control. This combination is particularly powerful in crypto markets, where cycles can be extreme and opportunities can arise suddenly.

Most importantly, hybrid funds can maintain dry powder through market cycles - an advantage over pure liquid funds that often must maintain high market exposure and venture funds that can find themselves fully deployed at market peaks.

New Frontier of Value Capture

The emergence of the new liquid funds as sophisticated market participants has accelerated the new frontier of value capture mechanisms in crypto markets. With their focus on fundamental analysis and sustainable value creation, these funds are pushing protocols to develop and implement more sophisticated approaches to value accrual.

Beyond Simple Token Economics

The industry has moved beyond basic token economics based on supply restrictions and speculative demand. Instead, protocols are developing diverse mechanisms for sustainable value capture and distribution. This evolution is driven by the need to create genuine utility and measurable returns for token holders.

The current landscape includes several primary approaches to value capture:

Direct Fee Sharing represents the most straightforward approach, with protocols like GMX and dYdX demonstrating how trading fees can generate meaningful returns for token holders. These mechanisms provide immediate, measurable value streams that can be modelled and valued using traditional financial metrics.

Buyback and or Burn strategies, take a different approach by using protocol revenue to reduce token supply. While this method can be effective in certain market conditions, its value creation potential depends heavily on market dynamics and execution strategy. More sophisticated variants include buyback and distribute models, where tokens are purchased regularly for distribution to long-term holders, creating active market participation while rewarding holder loyalty.

Treasury reinvestment, has evolved far beyond simple asset holding. Modern protocols are granting token holders unprecedented control over treasury assets, allowing for sophisticated reinvestment strategies. This includes strategic investments in protocol development, liquidity provision to key markets, ecosystem growth initiatives, and research funding. The key innovation is the community's ability to direct these investments through governance, creating a dynamic balance between immediate value distribution and long-term growth.

The Fee Switch Revolution

Perhaps the most significant development in value capture mechanisms is the emergence of fee switches as a flexible tool for protocol governance. The case of Uniswap, with its potential $1 billion in annual revenue, highlights both the opportunity and complexity of implementing such mechanisms.

The decision to activate a fee switch involves balancing multiple considerations:

Competitive dynamics and market share implications

Regulatory compliance and securities law considerations

Protocol sustainability and growth requirements

Technical implementation and security factors

The decision to activate a fee switch involves balancing competitive dynamics and market share implications, regulatory compliance considerations, protocol sustainability requirements, and technical implementation factors. Liquid funds play a crucial role in helping protocols navigate these decisions, bringing sophisticated analysis to bear on questions of timing and implementation.

Maturity-Based Approaches

The appropriate value capture mechanism often depends on a protocol's stage of development and market position.

Early-stage protocols may legitimately focus on growth and market share acquisition, reinvesting revenue into development and liquidity. However, they must now have clear models for how this translates to future value capture potential.

Established protocols with significant market share can implement more direct value capture mechanisms, using their strong position to generate sustainable yields for token holders while maintaining competitiveness.

Infrastructure protocols face unique challenges in balancing value capture with platform growth, often requiring hybrid approaches that combine multiple mechanisms.

A New Paradigm

The crypto market is entering a new phase where narrative-driven speculation alone will no longer suffice. Several key factors are driving this transition:

Institutional Demand: Traditional financial institutions are increasingly looking to participate in crypto markets, but require clear value creation mechanisms and sophisticated valuation frameworks. This is pushing protocols to develop more sustainable business models and transparent tokenomics.

Market Segmentation: Pure speculation is migrating toward memecoins, while serious protocols are focusing on building sustainable revenue models and value capture mechanisms. This natural segmentation is creating clearer market dynamics and expectations.

Value Creation Focus: Projects are increasingly judged on their ability to generate and distribute value rather than their narrative potential. This shift is particularly evident in DeFi, where protocols like Uniswap demonstrate the potential for substantial revenue generation.

Regulatory Tailwinds

The regulatory environment, particularly in the United States, appears to be evolving in a way that could accelerate this transition. Clearer frameworks for token classification and fee-sharing mechanisms could allow more protocols to implement direct value capture models without regulatory concerns.

This could lead to:

More protocols implementing fee switches

Better alignment between project success and token holder returns

Increased institutional participation in DeFi

The Maturing Market

As the crypto market matures, two key trends are emerging that will shape the industry's future trajectory - the development of protocols focused on sustainable value creation, and the rise of hybrid investment strategies led by active liquid managers

The Rise of Value-Driven Protocols

At the core of the market's maturation is the evolving landscape of value capture mechanisms. Protocols are developing diverse tools to generate and distribute genuine value for token holders, moving beyond simplistic models.

Projects that demonstrate clear product-market fit and sustainable value accrual for their communities are poised to thrive. Mechanisms like fee switches, buybacks, and treasury reinvestment programs represent a shift toward utility and tangible returns.

Investors will increasingly seek fundamentally-sound protocols that can align incentives and deliver value. As the market matures, advanced value capture, better protocol-holder alignment, and greater institutional participation in these projects will define the next phase.

The industry's forward-thinking participants, embracing hybrid strategies and value-driven protocols, will be best positioned to thrive in the evolving crypto landscape.

The Hybrid Advantage

A hybrid approach blending venture capital and liquid fund structures offers the greatest strategic advantages. Liquid fund managers, with their ability to actively engage with protocols, dynamically manage positions, and implement sophisticated risk controls, are poised to lead this hybrid charge.

The hybrid structure provides liquid managers agility to participate in early-stage opportunities while maintaining flexibility to adapt to volatile cycles. Critically, it enables them to preserve dry powder - a key edge over rigid venture or liquid-only strategies.

The hybrid managers' ability to actively switch between liquid and venture investments is a crucial advantage. By nimbly navigating market cycles, they can minimise drawdowns and capitalize on opportunities as the market recovers. This active management approach sets them apart from passive, beta-focused strategies.

The Path Forward

The next phase of crypto market evolution will likely be characterised by more advanced value capture tools, better alignment between protocol success and token holder returns, and increased institutional participation in fundamentally-driven projects. Those protocols that can identify, create, and capture real, lasting value will be best positioned to succeed in the maturing digital asset ecosystem.

Together, the hybrid advantage of active liquid-focused managers and the rise of value-driven protocols represent the key pillars of the crypto market's maturation. By embracing these trends, the industry's most forward-thinking participants will be poised to thrive in the evolving crypto landscape.