Bitcoin regained ground last week, with a roughly +5.5% week over week performance after reclaiming key level of 87k which we mentioned in our previous weekly. Reversing part of the prior weeks sell off. The total crypto market cap likewise bounced to 3.07T, up 5.2%. After a sharp drawdown in November, this represents a strong technical relief, but market cap is still down ~$600 B relative to early November Notably, major altcoins outperformed BTC modestly as risk sentiment recovered.

Technical indicators support the rebound, the daily RSI has snapped up from oversold, currently at 41 and market sentiment has noticeably improved. The Crypto Fear And Greed jumped into 20s, reflecting a shift from panic to cautious. In short, Bitcoin has reclaimed key support and momentum, closing above $91,200 opens up for short term targets of 94k/95k/100k.

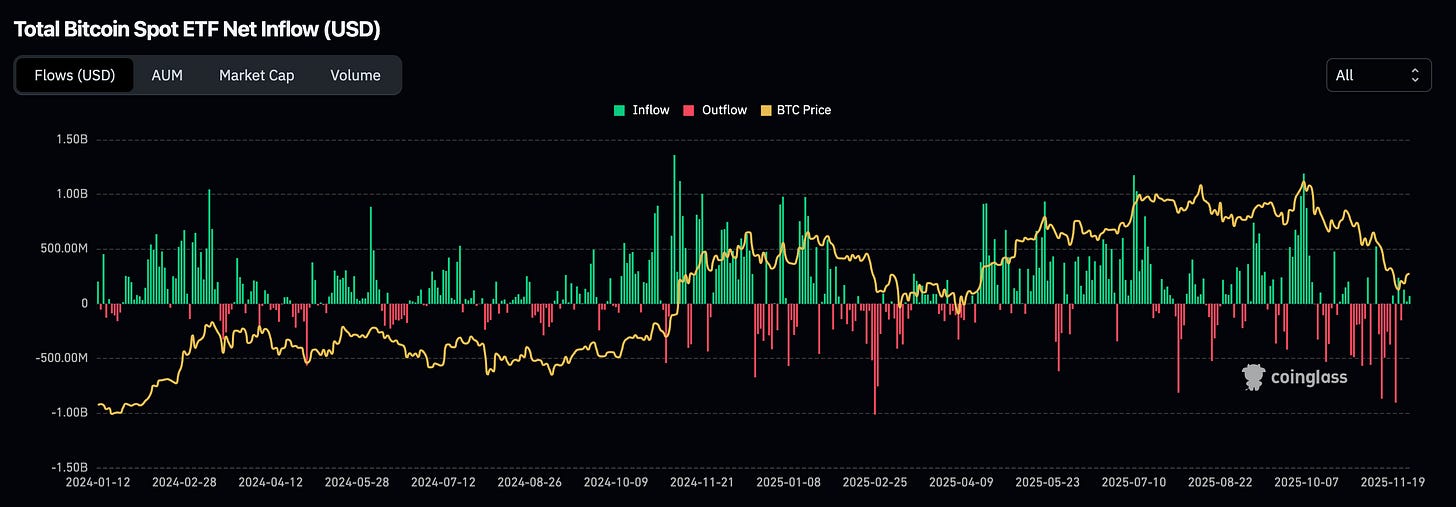

Bitcoin ETF flows and liquidity dynamics have shifted. After a reported $1.2B of outflows between 17-23 Nov, the late-November rally coincided with renewed net inflows. This combination of a BTC price rebound and ETF demand hints stabilisation and slow momentum.

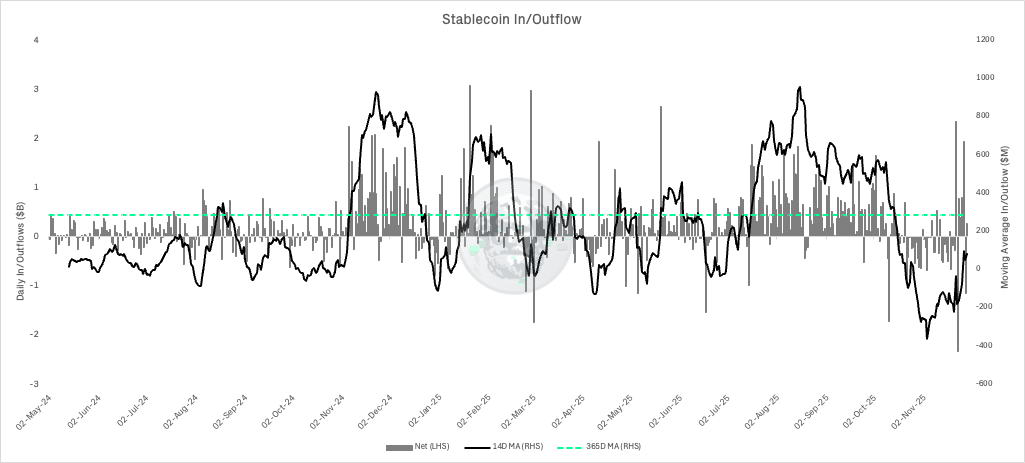

Meanwhile, onchain stablecoin flows remain subdued. The data shows that the 14-day moving average net inflow is currently about $80M (coming out of negative territory), far below the ~$286 M average over the past year.

In other words, current stablecoin dry powder is low, below the 1yr average, suggesting limited new buying pressure. Capital has not yet flooded back into crypto, implying market participants remain cautious. Overall, crypto markets staged a technical recovery this week, but without a return to exuberance, sentiment is far from bullish.

Macro

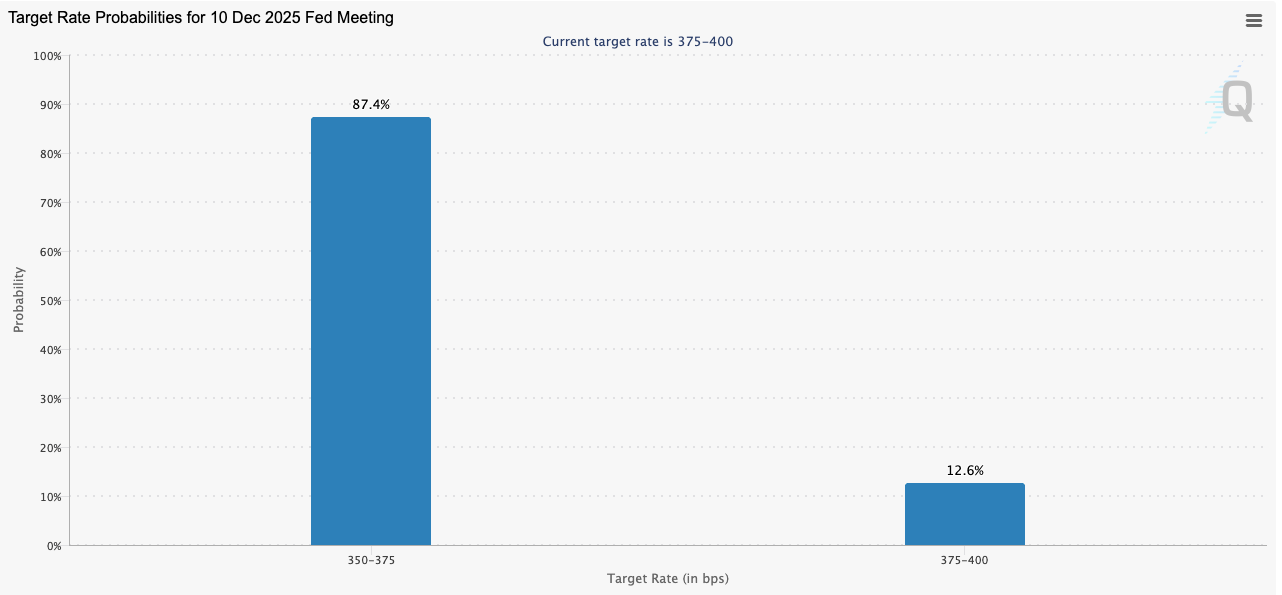

Global markets this week were driven by data and policy expectations. Fed policy expectations continues to rise, currently pricing in 87.4% probability for a 25bp cut, up from 71% a week ago. Fed officials reinforced this shift, New York Fed’s Williams and San Fransisco Fed’s Daly said recent data have weakened enough to warrant another 25bp cut.

At the same time, regulators finalised changes to the Enchanced SLR (eSLR) framework, more important than it sounds. The eSLR determines how much capital banks must hold against their safest assets, including U.S. Treasuries and cash-like repo exposures. Under the previous rules, Treasuries still consumed balance-sheet capacity, making it costly for banks to expand their holdings or to intermidate in repo markets.

The newly finalised adjustments reduce the capital penalty for holding Treasuries and engaging in repo. In practice, this means:

Banks can hold more Treasuries with the same amount of capital, lowering the marginal cost of absorbing new government issuance.

Banks can expand their repo activity, which greases the plumbing of the financial system and ensures dealers can finance inventory more easily.

Treasury market liquidity improves, because there are now more balance-sheet “slots” available across major banks.

This is effectively a stealth liquidity injection, not through QE but through regulation.

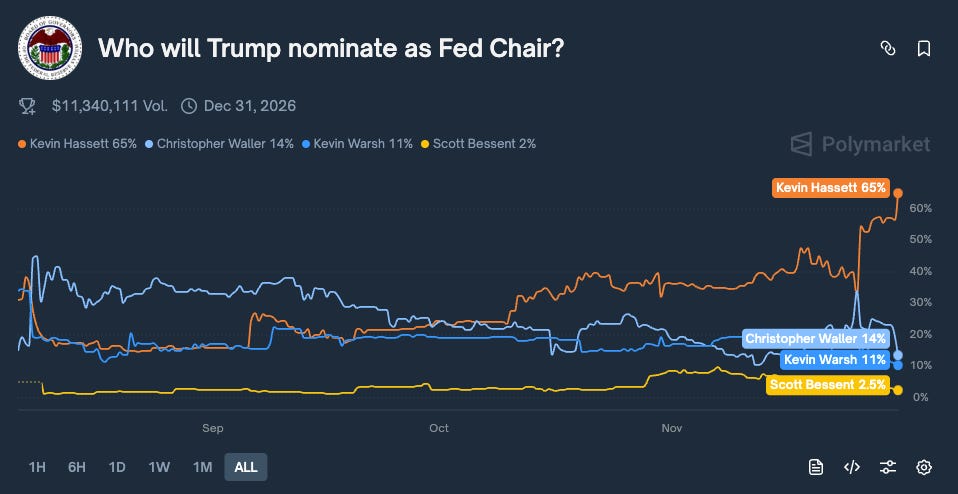

Adding to the narrative, political chatter revived over Fed leadership

Reports suggest Trump’s team is eyeing former White House economist Kevin Hassett as a Fed Chair candidate. Hassett is known for favouring pro-growth policy, lower real rates, and a more accommodative stance toward employment-driven expansion. His appointment would signal a clear pivot toward a dovish, Treasury-aligned Fed.

In sum, Fed cut expectations have been repriced sharply, liquidity conditions are set to ease, and markets have rallied on the “Fed whisper” of future easing.

Current Outlook

Short-Term

The crypto bounce looks poised to continue unless fresh weakness emerges. Bitcoin has now reclaimed the low-$90s and is pushing into the $92K–95K resistance band. This is the first major supply zone to clear. A decisive break above would open the path toward the $95K–100K liquidity pocket, with $100K serving as the next clear psychological and structural target.

Momentum supports continuation: the RSI has fully recovered off oversold, still with ample room before overbought, and sentiment has improved materially — the Crypto Fear & Greed Index has risen back into the 20s after bottoming at 9 prev week. As long as BTC holds above the reclaimed $91K–92K support, the path of least resistance remains upward.

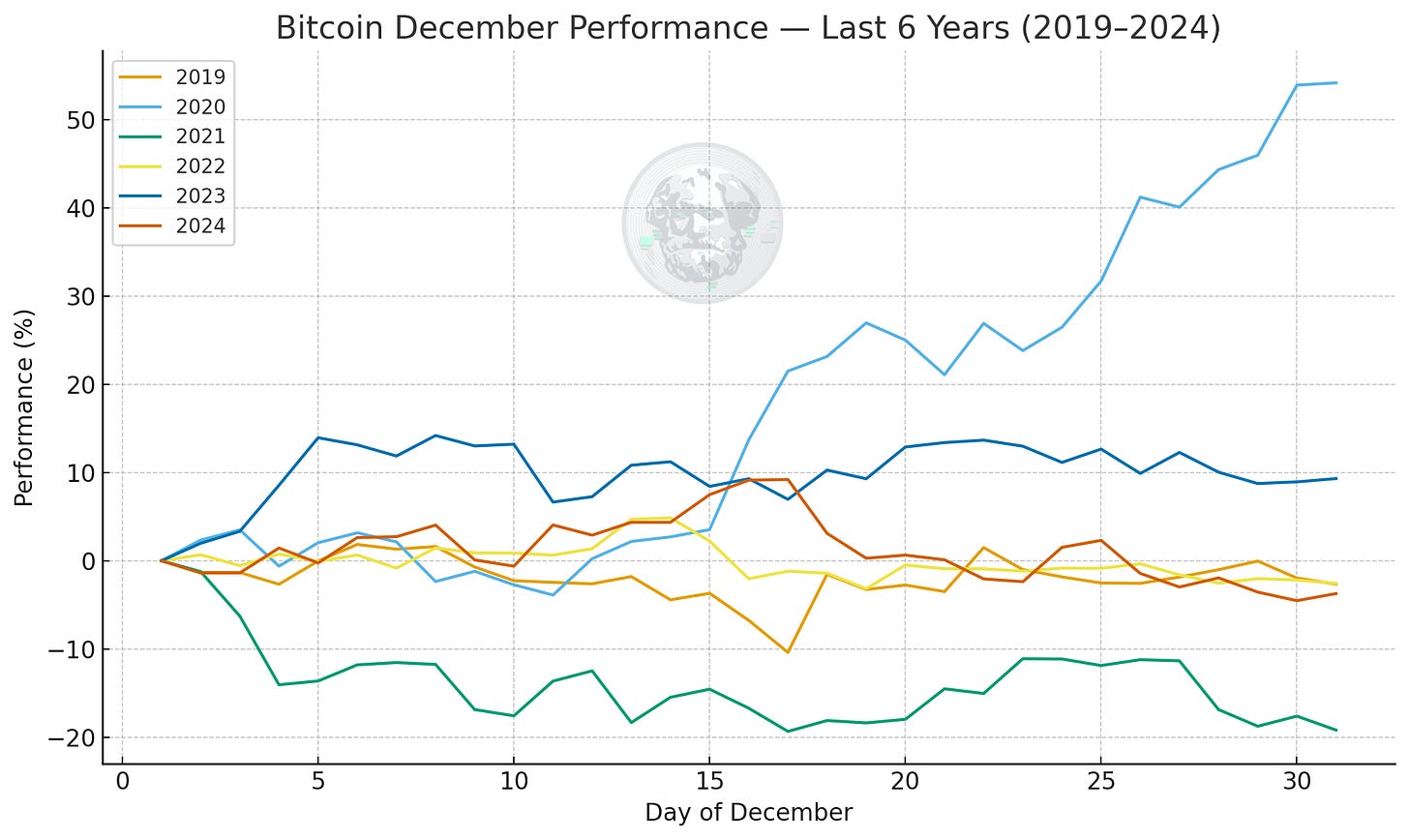

The complication now is December seasonality. When isolating the last six years of Bitcoin price action, a clearer pattern emerges: BTC often changes behaviour around mid-December, but the direction of that shift depends entirely on the prevailing liquidity regime.

In strong years, mid-month has marked the point where upside momentum accelerates; in weaker years, it has been where early-month weakness stabilises; and in mixed or fading environments, like 2024, it has been the point where the market rolls over. Crucially, this is not a reliable “Santa rally” dynamic as seen in equities, but rather a moment of inflection, where positioning, liquidity and risk appetite tend to recalibrate into year-end. In other words, December doesn’t impose a bullish or bearish bias on Bitcoin, it simply amplifies the trend the market is already in, with mid-month acting as the pivot.

Medium-Term

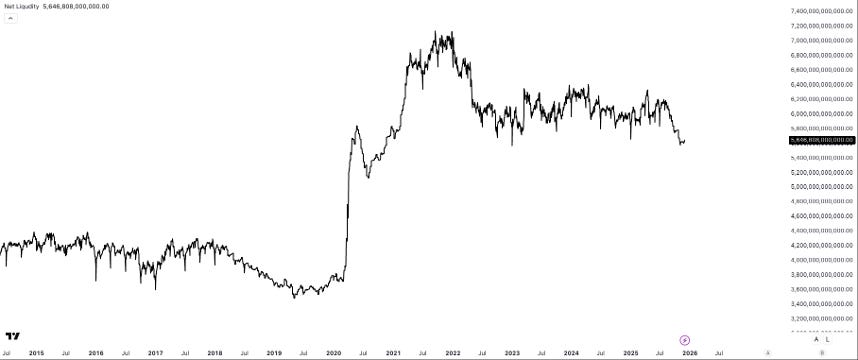

The medium-term outlook still comes down to one thing: liquidity. U.S. net liquidity, defined as the Fed’s balance sheet minus the Treasury General Account and the Reverse Repo facility, sits near $5.65 trillion, well below its 2021–2022 peak, and continues to grind lower.

The mechanical effect of this is simple: when net liquidity falls, financial conditions tighten, credit creation slows, and the marginal buyer of risk assets weakens. Crypto, which sits at the far end of the risk curve, is typically the first to feel that tightening. Even though QE is to be expected sooner rather than later the when not if is the big questions. In the short term we can see a move higher with TGE moving lower.

Equities are already showing signs of fatigue. Both the S&P 500 and Nasdaq have spent the past few weeks pinned against their 50-day moving averages, repeatedly testing but failing to build sustained momentum above them. That kind of behaviour usually signals stretched positioning and a lack of incremental buyers, a symptom of thinning liquidity and late-cycle complacency.

Valuations, particularly in tech, are now heavily reliant on the continuation of the AI capex boom, which powered markets through 2023–2025. But forward guidance from hyperscalers and cloud providers is starting to cool, and investors are increasingly questioning how much further multibillion-dollar GPU and data-centre spending can scale. If AI capex slows in 2026, the market loses one of its key demand engines, placing pressure on already elevated multiples. In that scenario, equities would be vulnerable to a broader repricing, and crypto, with its high beta to risk sentiment, would not be immune.

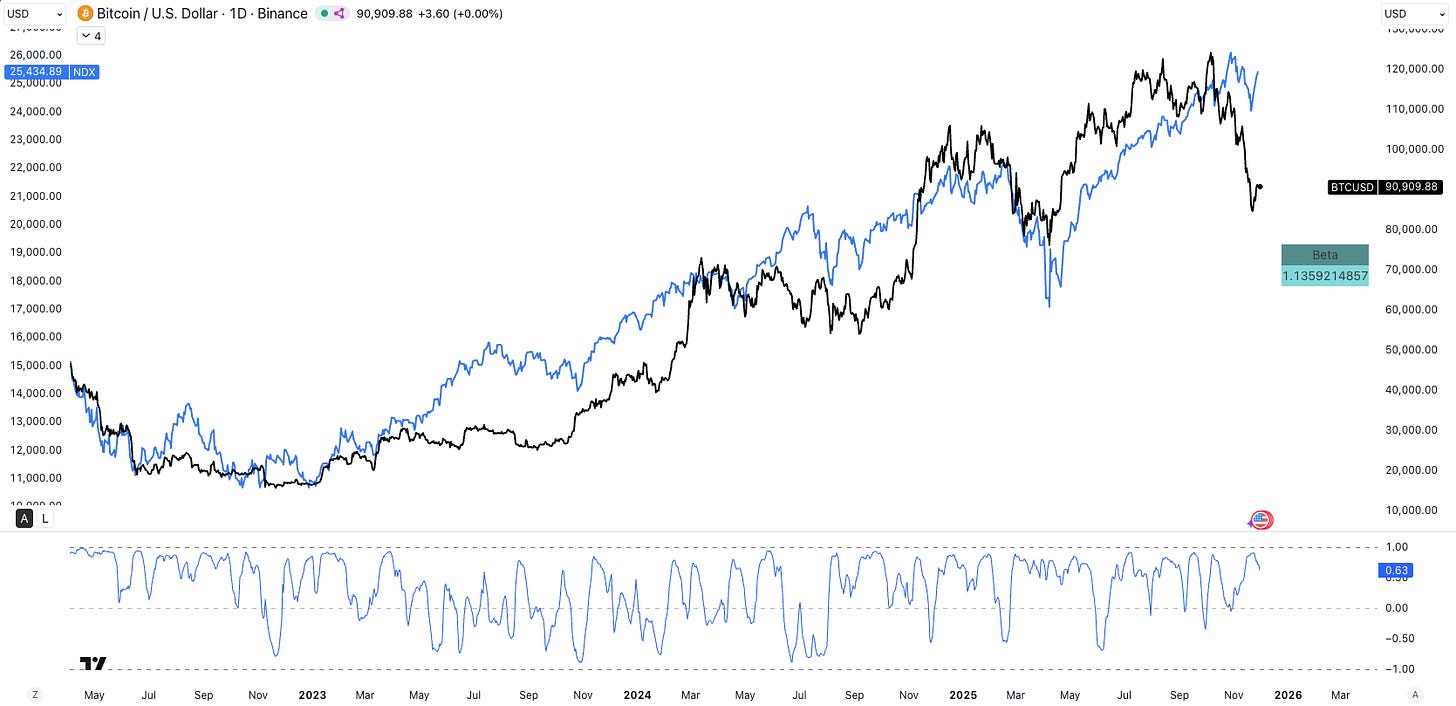

For Bitcoin, this linkage to equities is becoming even more important. The latest data show BTC’s 60-day beta to the Nasdaq has risen to 1.14, with the 1-month correlation now at 63%

Meaning Bitcoin is moving not just in the same direction as equities, but with amplified sensitivity. That’s still low enough for crypto to produce its own short-lived narrative cycles, but high enough that any meaningful equity drawdown reliably spills into BTC. In a liquidity-tight environment, that correlation acts like gravity: a 10–20% pullback in the Nasdaq would likely drag Bitcoin into the $65K–$75K structural support region.

The only periods where BTC has sustainably outperformed equities and where correlations briefly turned negative were during strong, self-reinforcing narrative build-ups (early 2021 institutional flows, the 2023 ETF front-run). But those episodes fade quickly unless backed by improving liquidity. Outside of them, crypto trades as a leveraged expression of global risk appetite, and without a new liquidity impulse, that dynamic is unlikely to change.

Long-Term Thesis

Despite near-term volatility, the long-term backdrop for crypto continues to strengthen. The key shift is that monetary power is no longer concentrated solely at the Federal Reserve. With the Fed now effectively done shrinking its balance sheet and the recent eSLR reforms giving banks more capacity to hold Treasuries, the centre of gravity is tilting toward the Treasury and the fiscal side of policy. In practice, this means U.S. liquidity will increasingly be determined by the government’s funding needs rather than by Fed balance-sheet decisions.

Those funding needs are enormous. TBAC projections show annual deficits rising above $2 trillion by 2027, implying a surge in Treasury issuance over the coming years. That issuance, by definition, injects liquidity into the financial system as the government spends more than it collects. And critically, parts of the crypto ecosystem are now structurally tied to this Treasury supply. The 2025 GENIUS Stablecoin Act, which requires USD stablecoins to be backed 100% by cash or short-term Treasuries, effectively turns stablecoin adoption into a continuous source of Treasury demand. As stablecoins grow, so does the government’s ability to finance deficits, creating a feedback loop where Treasury liquidity and crypto market depth increase together.

The policy environment is shifting alongside this. Congress is advancing a unified Digital Asset Market Structure framework (Clarity Act), providing long-sought regulatory certainty for institutional capital. Proposals like Senator Lummis’s Bitcoin Act, which would allow the Treasury to accumulate up to one million BTC over several years, reinforce the idea that digital assets are being pulled into the core of U.S. financial strategy. At the same time, retirement providers are opening the door for 401(k) allocations into digital assets, introducing long-horizon, recurring inflows from one of the largest pools of capital in the world.

Layered on top of this is the potential for additional fiscal support, including proposals such as the mid-2026 “tariff dividend” cash transfers to households. If enacted, this would add another wave of liquidity at a time when the structural drivers, Treasury issuance, stablecoin expansion, regulatory clarity, and retirement-system inflows are already turning decisively supportive.

Taken together, these developments point toward a future in which crypto becomes both more liquid and more institutionally embedded, benefiting directly from fiscal expansion, stablecoin adoption, and formal policy integration. The path will not be linear, political cycles, regulatory negotiations, and macro volatility will create setbacks, the long-term structure is unmistakably bullish.

Conclusion

In the near term, crypto trades on liquidity and positioning; in the medium term, it trades on equities and broader risk appetite; but in the long term, it will trade on structural demand, regulatory clarity, and fiscal integration. With those forces increasingly aligning, short-term volatility looks more like noise within a much larger, strengthening trend.

Position accordingly