The Insider #8 - 27 Nov 2023

The Evolution of Crypto: Transitioning to the Value Creation Phase

Unpacking the signal

Crypto assets has come a long way since Bitcoin’s inception in 2009. What began as an ideological experiment has rapidly evolved into an emerging asset class with over $1.4 trillion in market capitalization. This exponential growth has not come without growing pains.

The recent crypto winter erased nearly 75% of the market's aggregate value as rampant speculation came crashing down. Such severe repricing often serves as a painful but necessary catharsis before industries mature.

Despite the challenging backdrop, evidence suggests crypto is progressing into a new phase focused on building sustainable, real-world value rather than chasing short-term speculation. With excesses now wrung out, the ecosystem appears positioned to combine boundary-pushing innovation with free market discipline.

As periodic frenzies give way to practical integration, the foundations seem to be settling at a new plateau. Indicators that the building blocks are cohering to support this next stage of broader adoption through pragmatic decentralization.

Outlasting Creative Destruction

The crypto bubble popping destroyed droves of weak projects unable to deliver lasting value, but high-quality protocols and applications have continued gaining user traction. The best have carved clear product-market fit across decentralized finance, NFTs, metaverse infrastructure, social networking, and more.

Similar to how adding ".com" to a name may have temporarily boosted valuations in 2000 just like appending “blockchain” did in 2020. But transient fads fade - ultimately users flock to solutions offering clear utility solving real problems.

When the internet stock frenzy collapsed in the early 2000s, it wiped the equity values of countless ventures but left in its wake the seeds of titans like Amazon and Google. The avenue to build them had been cleared. The mania had funded a Cambrian explosion of infrastructure development. And while most efforts collapsed under their own hubris, the strongest ideas found product-market fit and quietly built the foundations during the winter for the next computing wave.

Composability is enabling creative combinations of tools and digital assets that exponentially expand use cases. Incubators and support for promising projects have thrived amidst volatility, sustaining growth runways during this pruning process.

Billions in venture capital has flowed into teams building essential infrastructure even as prices collapsed. Over the past year (H1 2022-H1 2023), Ethereum had 1,826 projects funded, followed from afar by Polygon (MATIC), with 1,076 funding.

Venture capitalists are becoming more selective in deployment, concentrating capital around the highest quality teams best positioned to drive the next wave of adoption. Many companies funded at the peak now face reconstituting ownership stakes or enacting restrictive round conditions to attract support. While the bar to raise has sharply risen, this selectivity allows the cream to rise. Close scrutiny forbids relying on speculative hype. Investors now demand substance - strong technical foundations, encouraging traction momentum, defensible network effects.

The sector also now appears to be shaking off overhang risks like exchange implosions, bank runs, regulation uncertainty, and liquidity crunches that triggered domino effects. While fragility remains in pockets, stress testing may limit future systemic crises.

Maturing Infrastructure and Practices

Technical infrastructure enabling secure and intuitive mainstream accessibility has seen immense strides across blockchain networks, standards, financial rails, identity solutions, interoperability protocols, and sustainability.

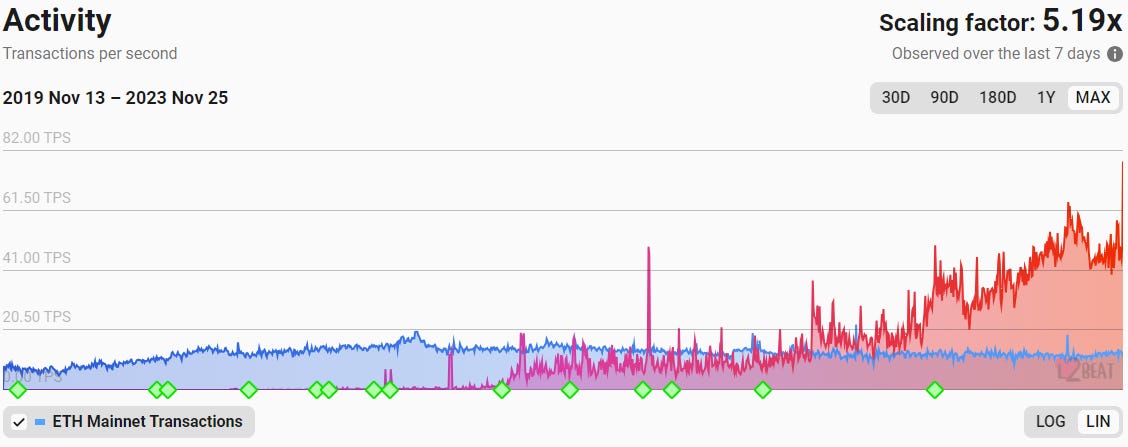

Scalability and throughput have grown exponentially while costs and latency plunged. Hyper scalable networks support thousands of transactions per second with sub-second finality, rivalling traditional payment channels. Leading layer 2 solutions in Ethereum are further enhancing throughput and reducing expenses.

Developer environments are evolving into robust technology stacks that allow specialist and non-specialist creators alike to build secure applications with relative ease through modular components as mentioned in The Insider #6 - 13 Nov 2023

From self-custody wallets to decentralized exchanges, the once complex crypto user experience has transformed towards mainstream usability, though still early stage. Integration layers enable users to access Web3 applications without even needing to hold crypto assets directly.

Regulatory clarity is steadily increasing across jurisdictions to provide structural guardrails without impeding responsible innovation. In parallel, the industry is coalescing around standards and best practices in areas like audits, transparency, governance, financial stability, and consumer protections to sustain trust and engender tacit cooperation with prudent authorities.

Improving Risk-Rewards and Institutional Interest

Now that rampant speculation has been cleansed, crypto's risk-reward proposition appears more constructive for long-term exposure.

Quality assets are trading 50-90% below all-time highs despite demonstrated product-market fit across sectors like decentralized finance. Compared to the uncertainty of early days, established networks have proven utility and developer ecosystems. The risk of total loss seems reduced while upside potential remains over 5 year timeframes.

As iterative stress testing hardens networks, the next growth wave could expand exponentially akin to the internet's rise last decade. First movers positioning amidst the despair could generate outsized returns.

Meanwhile, the approval of Bitcoin and Ethereum spot ETFs by the SEC validates growing institutional interest in accessing crypto exposure. Trillion dollar asset managers have limited avenues to allocate to digital assets directly - ETFs provide regulated vehicles aligning with their standards. In parallel, traditional finance firms like JP Morgan’s carries out its first crypto based settlement with Blackrock and Barclays over its Ethereum-based Onyx blockchain.

Seeing sophistication around risk management improves while credibility expands through regulatory endorsements indicates maturing infrastructure. For prudent institutions, evaluating crypto merits serious consideration given its network effects.

Crossing the Chasm

Geoffrey Moore's technology adoption life cycle offers an apt framework to analyse crypto's progression.

The first era from Bitcoin's inception through 2017 mania was driven by innovators and early adopters attracted to decentralizing money - visionaries undaunted by complexity seeking a new technological frontier rather than material rewards per se.

The following years brought renewed waves of eager speculation as concepts like DeFi, NFTs, and the metaverse captured investor imagination. The ICO boom and return of retail hype amplified the frenzy. This phase largely centred on hype-driven asset price appreciation fuelled by risk-taking enthusiasts rather than more conservative pragmatists focused on real-world utility. As warnings signs flashed, the crypto bubble peaked then came crashing down as exuberance detached from reality became unsustainable.

For crypto to progress to mainstream adoption, it must now cross the chasm to solving everyday problems for practical consumers uninterested in speculative gambling or understanding technological intricacies. They simply want solutions that work easily and reliably without imposed learning curves.

This transition requires a reorientation from teams building Web3 infrastructure today. Rather than catering to enthusiastic early adopters attracted to novel technological frontiers, the focus needs to shift towards onboarding mainstream users through simplified user experiences.

Cryptocurrencies and decentralized applications should compete on the merits of convenience, value, and reliability rather than novelty or short-term rewards. Friction must give way to seamless accessibility across onboarding, asset transfers, transactions, security, governance, and troubleshooting.

The gap still appears but steadily narrowing as breakthroughs in usability, scalability, and applicability help bridge towards mainstream utility. Though crypto may look years away from mass adoption, the foundations may sufficiently mature to cross the chasm before another wave gathers momentum

The Long-Term Value Creation Opportunity

While traders face continued challenges amid market turbulence, long-term investors can capitalize on conditions reminiscent of past technological inflection points.

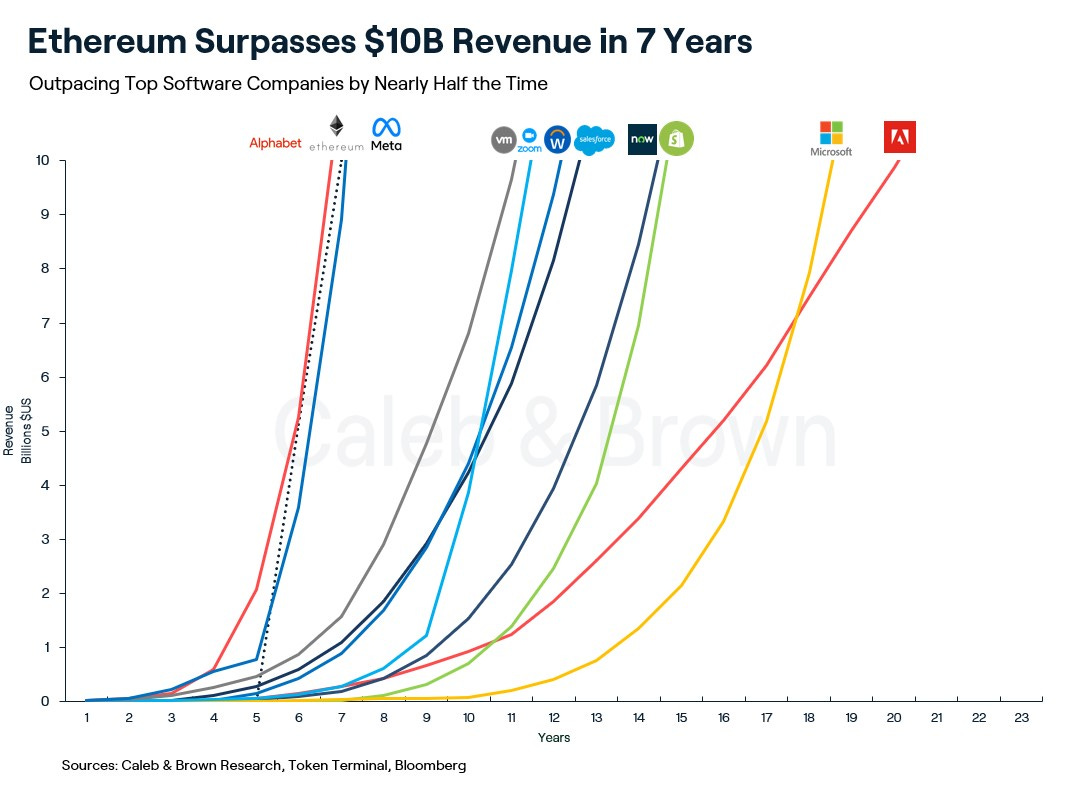

Across computing and the internet, progress traced exponential s-curves as infrastructure matured, speculation faded, and valuations disconnected from burgeoning utility. Crypto appears to be traversing a similar transition toward broader integration.

Market distress reflects short-term adoption headwinds related to UI complexity and regulatory uncertainty. However, analysing indicators suggest the space remains firmly on an upward trajectory as barriers to access progressively recede.

Developer participation continues undimmed. Institutional avenues expand through spot ETF approvals. Enterprise blockchain adoption gains momentum. True decentralized global finance may arise through this decade’s technological leap.

Crypto winter plunging valuations by 75%+ may obscure the forest for the trees, but blockchain’s long-term prospects shine bright. While risks loom amid this paradigmatic shift, previous transformations reward those taking a long view, driven by fundamental research, when underlying platform utility becomes undeniable.

Now appears one of those foresighted investment opportunities. Infrastructure building amidst scepticism sows the seeds for exponential growth on the horizon. As crypto progressively mainstreams in usability and reliability, participation promises exposure to historic technological adoption.