Cryptos Uptober rally remains on pause as markets pulled back last week. Total crypto market cap fell -3.1% week-over-week and finished the week at $1.04 trillion, down -1.8% month-to-date. Leading gainers were Klaytn (+8.2%), Trust Wallet Token (+5.7%), and Frax Share (+5.6%).

Out of the top 50, only 6 cryptocurrencies has a positive week, while majors Bitcoin dropping -2.9% to $27k and Ethereum -4.3% back to March lows of $1,550. Biggest underperformers included Radix (-17.9%), Mantle (-15.4%), and Kaspa (-12.3%).

Grayscale Bitcoin Trust (GBTC) discount shrinks to 15.8%, down from 43% in mid-June when BlackRock applied for spot BTC ETF.

Bitcoin hashrate continues rising, now at 447 exahash per second, up 77% year-to-date.

Ethereum’s validator queue has dropped to 600, signalling weaker staking demand as rewards fall near 3.5%.

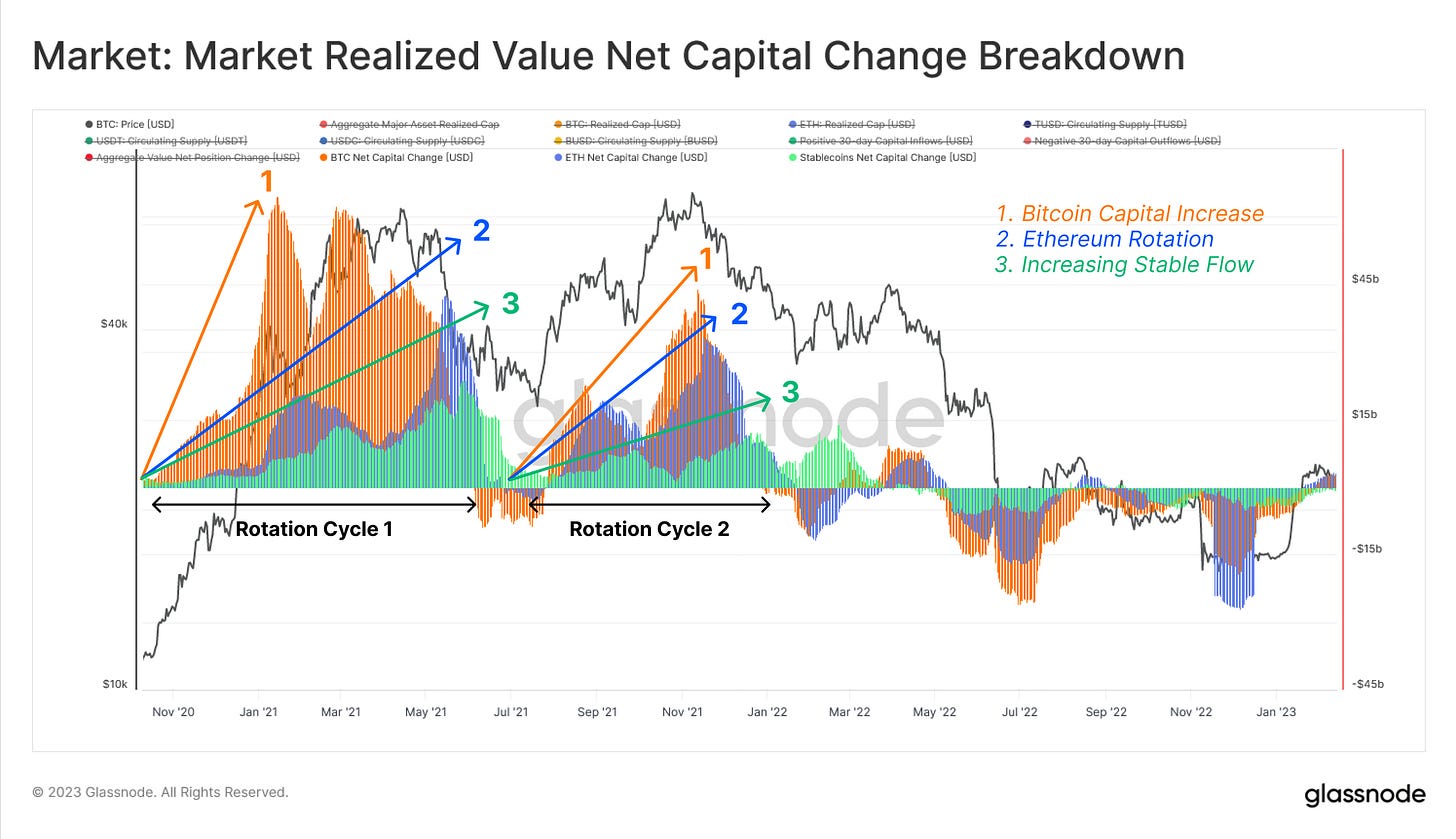

Historically, Bitcoin tends to lead the digital asset market, with market confidence then flowing towards Ethereum, and then further out on the risk curve from there. News that the SEC does not plan to appeal court decision allowing a Grayscale Bitcoin ETF gives a soft indication that rumours of SEC approvals are inching closer. This could ignite the first leg of a Bitcoin bull run and further boost dominance, currently at 50.91%.

Unpacking the Signal

I. BTC/ETH Falling Wedge

The ETH/BTC ratio has fallen -14% over the past year, declining to 0.058 - lows not seen since July 2022. But amidst this selloff, the ETH/BTC price action has formed a falling wedge pattern, signalling a potential bullish breakout ahead. This pattern occurs when an asset trends downward between two converging trendlines, with declining volume as the wedge progresses.

A break above the upper trendline often leads to upside. Key drivers of ETH's falling wedge include selling pressure from the Ethereum Foundation and FTX hacker.

The Ethereum Foundation sold 1,700 ETH recently from their reserves of 316.8K ETH. While their motivations are unclear, previous sales have funded operations and grants for developers. While their motivations are unclear, previous sales have tended to occur closer to market tops. However, their selling can also spark further declines in a self-fulfilling cycle scenario.

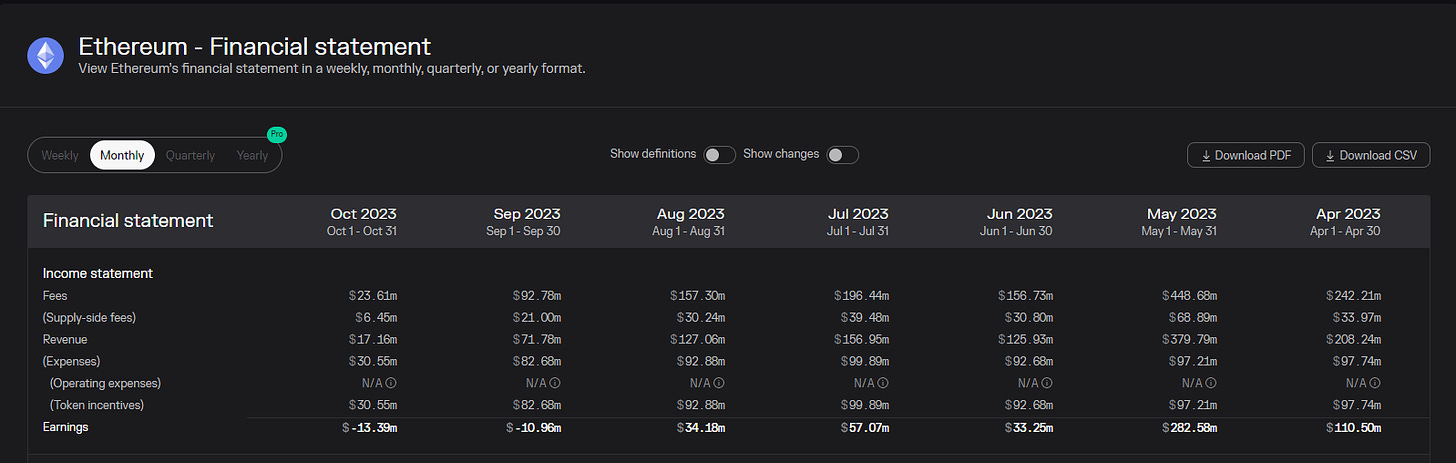

Adding pressure is declining on-chain activity – Ethereum on-chain earnings remained positive throughout 2023, except for September which saw losses of $10.96 million. So far in October, losses have totaled $13.39 million month-to-date according to TokenTerminal . These losses are directly related to decreased activity on the Ethereum network, contributing to recent ETH inflation. The downturn from previously positive earnings could be a factor in the Foundation's increased selling

Meanwhile, the FTX hacker continues to TWAP to swapping stolen ETH to BTC, with around 90,000 ETH remaining as of October 10. Their sales are algorithmically front-run, amplifying downward pressure.

Importantly, the 14-day RSI on the ETH/BTC ratio has reached oversold levels below 30, indicating the selloff may be overextended.

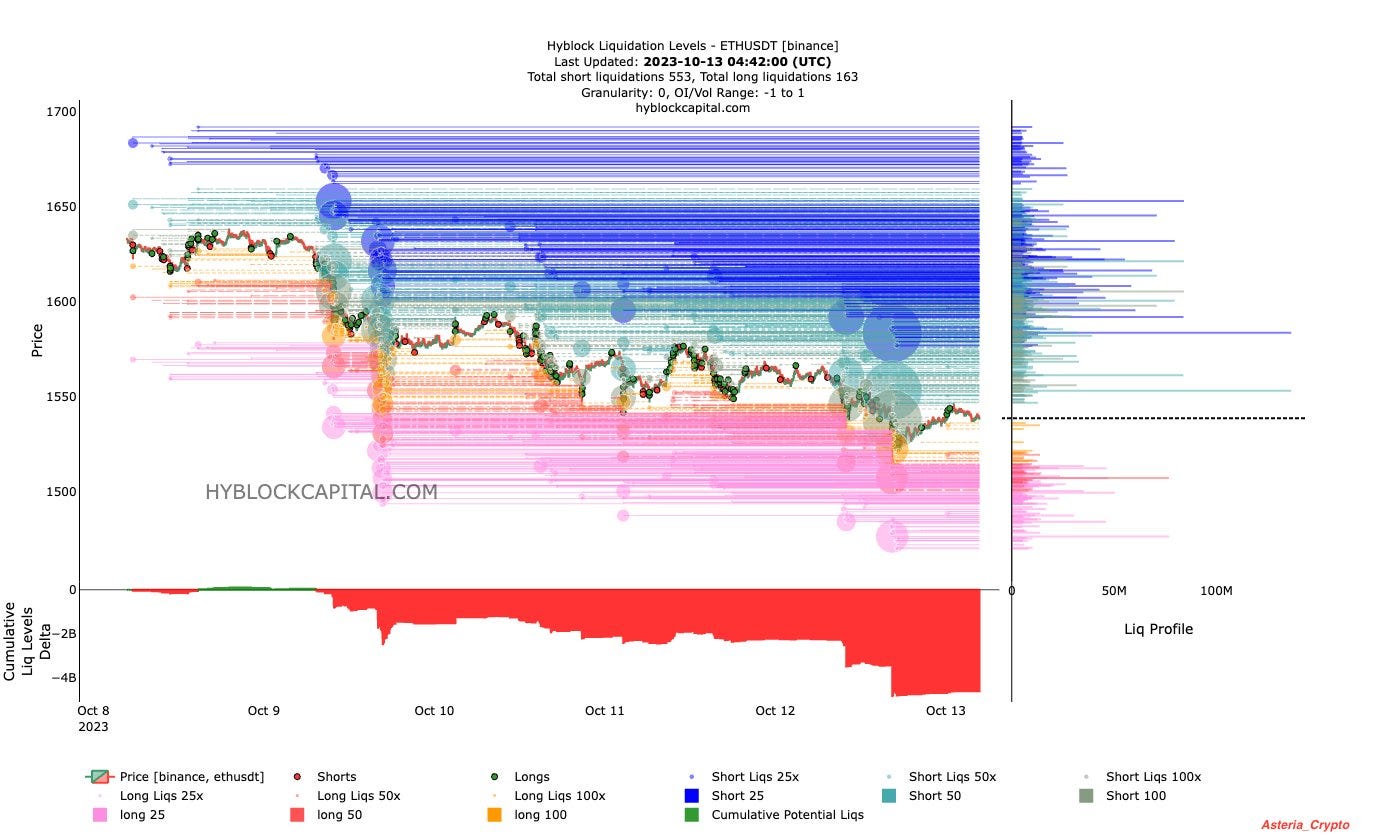

If ETHUSD declines 10% from psychological level of $1500 to around $1350, roughly $180 million of liquidations could be triggered on-chain. And a 20% fall to $1200 could amount to $475 million in liquidations out of a total of $2.7 billion.

Notably, the open interest heatmap shows short open interest is heavily skewed on Binance, with more leverage on the short side than the longs. This concentration of shorts creates conditions prone to liquidations if ETH/BTC reverses upward.

The pattern does present an attractive risk-reward scenario for traders using a tight stop loss. A break upward from the wedge could yield significant gains if timed properly, however looks to take time. Monitoring on-chain liquidation and leverage levels will be key.

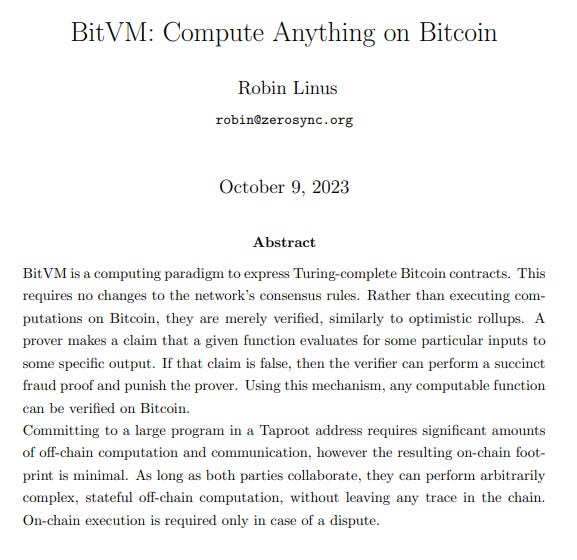

II. BitVM - Unlocking Smart contracts on Bitcoin

BitVM (Bitcoin Verifiable Machine) is a proposed protocol to enable increased smart contract functionality on Bitcoin without requiring network upgrades. By splitting computational logic across multiple transactions, it allows complex contract conditions to be validated on-chain through Script and fraud proofs. While performance is slow and costly compared to dedicated smart contract platforms, BitVM opens new possibilities for trustless decentralized applications on Bitcoin today.

The whitepaper created by Robin Linus of Zero Sync and released last week, utilizes Bitcoin Script, fraud proofs, and Taproot to enable computation to be broken up across multiple Bitcoin transactions. Users pre-sign a series of transactions encoding the computational steps, with a bond held in a 2-of-2 multisig to incentivize honest execution. If either party cheats, the counterparty can publish a fraud proof and claim the bond.

To progress the computation, outputs of each step are spent via pre-signed transactions that verify the contract state. In a back-and-forth cycle, the protocol progresses until the final state is reached. Taproot masks the pre-signed refund transactions to prevent chain analysis.

While computationally universal, BitVM performance is slow and expensive compared to purpose-built smart contract platforms. However, it opens new possibilities for trustless Bitcoin contracts today without requiring network upgrades.

Use cases like oracles and sidechain validators could potentially leverage BitVM for stronger security models, although throughput may be limited. Overall, BitVM represents an innovative avenue for expanding Bitcoin's programmability through technical sophistication rather than raw horsepower. Its applications may be narrow today, but could widen as Layer 2 solutions mature. BitVM offers another tool for Bitcoin to grow without compromising its core values or requiring network upgrades.

III. Liquid Staking Spawns a New Evolution

Liquid staking has exploded in 2023 to become the largest sector in Ethereum DeFi by far, with over $5 billion worth of staked ETH tokenized. Leading liquid staking protocol Lido alone accounts for over 30% of Ethereum's total staked supply.

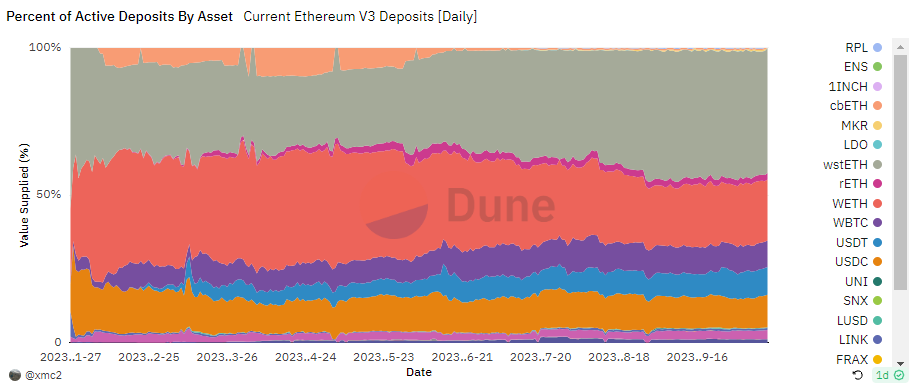

The rise of liquid staked assets like Lido's stETH has been staggering. As of October 2023, the market cap of wrapped stETH (wstETH) nearly matched native ETH, illustrating its growing traction as a yield-bearing counterpart. Year to date, the supply of wstETH has doubled from 1 million to 2.8 million ETH, while wrapped ETH has declined from 4 million to 3.3 million.

On lending markets like Aave, wstETH now comprises 42% of all TVL compared to just 15% one year ago. Aave holds 21% of all wstETH and 7.8% of stETH. This growth is driven by stETH's popularity as collateral for leveraged lending.

As wstETH supply begins rivaling native ETH, Lido’s 32.2% share of staked ETH raises concerns around decentralization and ecosystem health.

Ethereum co-founder Vitalik Buterin recently raised concerns over reliance on major staking providers like Lido and Rocket Pool. In his blog, He proposed, encouraging diversification across staking protocols as a short-term safeguard. Longer-term, solutions like minimal protocol-level changes could mitigate centralization risks.

Now, an evolutionary next step for liquid staking is emerging in the form of Liquid Restaking Tokens (LRTs). While plain-vanilla liquid staking tokens like stETH deposit ETH into staking protocols, LRTs take staked ETH and restake it into secondary DeFi applications to earn additional yield.

Restaking provides advantages like higher APYs but comes with limitations like illiquidity, high costs, technical complexity, and risk concentration into single protocols. This is where LRTs come in - they provide a liquid, easy-to-use wrapper for restaked ETH that mitigates downsides.

LRTs offer benefits like transferability, simplified restaking across multiple platforms to reduce risk, maximized yields from varied sources, and unlocked composability across DeFi.

While still early stage, infrastructure for LRTs is emerging from teams like Stader, InceptionLRT, and Restake Finance. If key risks around smart contract reliability, diversification constraints, and unclear regulation can be overcome, LRTs have massive potential to drive significant adoption and value like liquid staking before them.

But prudent skepticism is warranted given the cutting-edge nature of these instruments. Overall, LRTs represent an intriguing next step in the evolution of Ethereum's booming liquid staking landscape. Their uptake could introduce powerful new composability between staking derivatives and DeFi.

Global Macro Overview

While geopolitics gripped headlines, markets remained focused on interest rates. An initial flight to safety bid up Treasuries and eased valuation pressures on stocks.

But attention remains fixed on central banks amidst mixed signals. The September headline CPI held at 3.7%, while core ticked down to 4.1%. Reaccelerating shelter and energy inflation contributed, though gas has declined since. 10-year Treasury yields snapped a 5-week rising streak but remain sharply higher, ending Friday around 4.63%. Hedge funds continue amassing a historic short position, intensifying bond bearishness.

But countervailing stabilizing signals persist too. The ISM Manufacturing Index, composite measure of business sentiment, often bottoms ahead of the cycle, signalling recovery. Its current consolidation after a 2-year downtrend could indicate the worst is passing.

Still, caution is warranted. In 2023 so far in the US, 516 corporate bankruptcies have been recorded, double 2022's pace and 39% above the full-year count. Aside from 2020, levels are the highest since 2010.

Rising deficits also raise concerns, with the US posting a likely $2 trillion deficit for fiscal 2023 after accounting for reversed student loan forgiveness. This exceeds even 2008 crisis-era levels.

Bloomberg News reported on Tuesday, China is weighing new stimulus and higher deficit to meet its annual growth target. The Chinese authorities are mulling the issuance of at least CNY1 trillion ($137.1 billion) of additional sovereign debt for spending on infrastructure such as water conservancy projects, the sources added

Escalating Middle East tensions fuelled an oil price rebound nearing $88/barrel, although supply disruptions haven't materialized yet. History suggests conflict shocks often prove temporary.

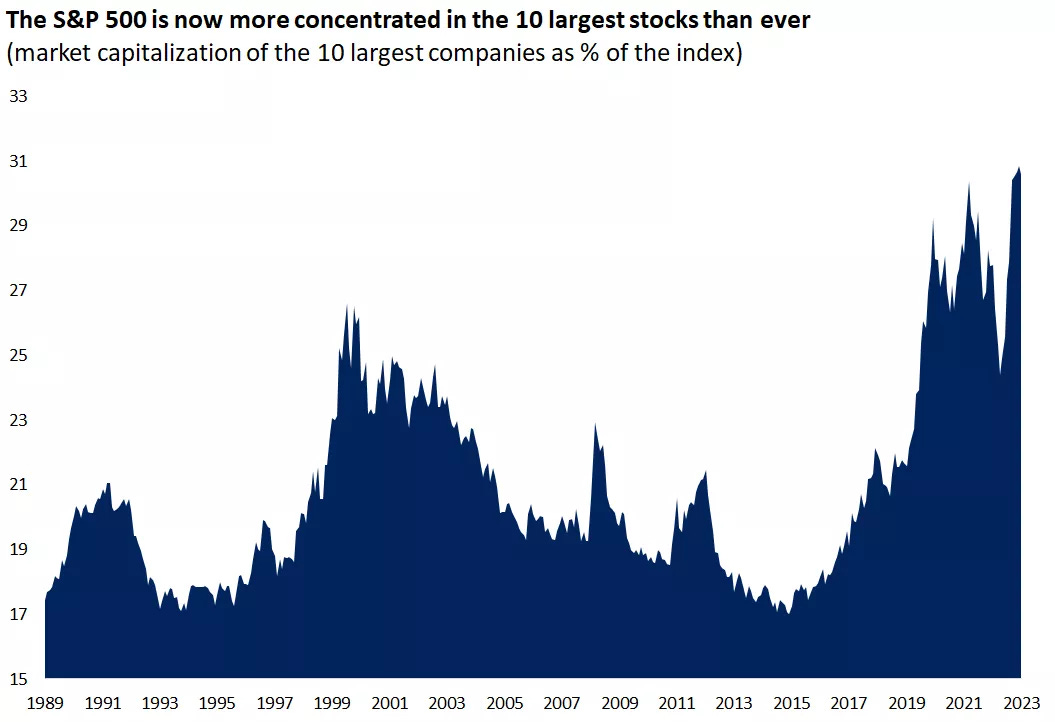

Upcoming retail sales could affirm resilient spending if the positive trend persists. But stock performance bifurcates: mega-caps like Apple substantially outperform while small-caps/equal-weight lag sharply. Apple's market cap alone outweighs the entire energy sector and small-cap universe, highlighting intense concentration even as risks mount.

While risks are mounting, cautious optimism isn't misplaced. Earnings season commenced with major US banks reporting Q3 results - each exceeded expectations for income and revenue. Analysts forecast S&P 500 earnings rising 0.4% on average, potentially breaking a 3-quarter declining streak, per FactSet. Inflation shows declining momentum, policy looks priced to peak, and data suggests the economy retains muscle. Yet volatility persists amidst deteriorating conditions. Patience and diversification remain key to navigating the churning waters ahead.

Across the Ecosystem

Polygon announced the Aalborg hardfork for faster deterministic finality

SEI Network launches Sei Marines, a revamped ambassador program in Galxe.

Uniswap launches mobile Ethereum wallet on Android

IoTeX has launched staking as an NFT, integrating with DeFi protocols.

DOT, Web3 Foundation committing 20m CHF & 5m DOT to support initiatives

Immutable and Amazon team up to advance Web3 gaming

Lido Finance discloses 20 slashing events due to validator config issues

Instadapp, Fluid, combines functionalities from Aave, Compound, Uniswap, Maker, and Curve aiming for January release

LayerZero goes live on OpBNB.

MetaMask expands crypto on-ramp options with Stripe integration

Mastercard successfully wraps up CBDC pilot with Reserve Bank of Australia

JPMorgan debuts tokenized BlackRock shares as collateral with Barclays

Parting Thoughts

October's crypto markets remain mired in uncertainty, with uptober's rally now a distant memory. Yet beneath the dour price action, optimistic currents still flow.

ETH's technical setup hints at a pending bullish breakout if buying volume returns, while BTC dominance rises as its lead dog status persists. Smart contract innovation continues as well, with BitVM unlocking new Bitcoin possibilities.

And Ethereum's thriving staking ecosystem births new yield frontiers like LRTs. Though risks around reliance on major validators like Lido linger.

Broader markets balance precariously too. While data affirms economic resilience, potential increase in liquidity from China, risks from inflation to geopolitics and corporate health persist. Patience and prudence remain vital.

Of course, crypto is no stranger to turmoil. Bear markets enable builders to lay stronger foundations. And each bust sows seeds of future growth.

So we endure winter's chill with optimism intact. Couched firmly in perspective, eyeing the thaw ahead. By reading each swell and runway, we chart the path forward through the storms.