The Insider - 02 Sep 2024

Decrypting the DEX Boom: Solana, Layer 2s, and the Memecoin Mania

In recent months, the cryptocurrency market has undergone a notable transformation, with decentralised exchanges (DEXs) seeing a substantial increase in trading volumes. The DEX to CEX ratio has now approached nearly 14% for the second time in its history, and this ratio has been on an upward trend since its inception in 2020.

This trend, especially evident on networks like Solana and Layer 2 solutions such as Base, has captured attention and prompted a closer examination of the underlying dynamics.

Key metrics include:

Solana (SOL) 1-year DEX volume: Increased 77x

Ethereum Layer 2s (ETH L2s): Increased 4x

Base (Coinbase L2): Increased 14x

Ethereum mainnet: Increased 1.7x

The dominance of the top five DEXs now accounts for 60-70% of all DEX trading volumes, highlighting the concentration within the market. As of August 2024, Uniswap leads the pack with a 28% share, followed by PancakeSwap at 11%, Raydium at 12%, Orca at 9% and Aerodrome at 5%. This consolidation suggests that a few key players are driving a significant portion of the activity in the DeFi space, which could have implications for competition, innovation, and market dynamics within the decentralised exchange ecosystem.

While these spikes might initially suggest growing adoption and liquidity in the DeFi space, a deeper analysis reveals a complex interplay of factors, including the rise of memecoins, potential market manipulation, and changing trader behaviuors.

In this comprehensive analysis, we'll dive deep into the data, examine the various factors contributing to this trend, and attempt to separate genuine growth from speculative noise. We'll explore the implications for different blockchain ecosystems, particularly Solana, and consider what these developments mean for the future of decentralised finance.

The Rising Tide of DEX Volume

DEX vs. CEX: A Shifting Landscape

Recent months have witnessed a significant shift in the ratio of DEX to CEX volume, indicating a growing preference for decentralised trading solutions. This change is driven by several factors:

Advancements in DEX technology have reduced issues such as slippage and impermanent loss, making these platforms more appealing. Additionally, increased speculation, fueled by higher risk appetites and permissive token listings, has intensified speculative trading. Coupled with rapid innovations in DeFi—offering new trading strategies and yield opportunities—these elements are drawing more users to DEXs.

Solana's DeFi Boom

Solana has been at the forefront of this DEX volume surge, with platforms like Raydium seeing substantial growth.

Raydium has significantly expanded its market share, rising from 21% to a peak of 60% in July. Currently holding 43% year-to-date, Raydium's remarkable growth underscores its strong performance in an increasingly competitive landscape. This leap not only reflects the platform's ability to capture a larger portion of DEX trading volumes but also highlights its growing influence among decentralized exchanges, positioning it as a key player in the evolving DeFi ecosystem.

However, a closer examination of Raydium's data reveals some concerning patterns:

Liquidity-Volume Mismatch: The top 50 pools on Raydium in terms of Total Value Locked (TVL) represent 1/3 of its total TVL but account for only 10% of the 24-hour volume.

High-Volume, Low-Liquidity Pools: Conversely, the top 35 pools in terms of volume (representing 1/3 of the total volume) hold just 10% of the TVL.

Suspicious Activity: Numerous pools show $5M+ in daily volume but minimal liquidity, raising red flags for potential wash trading.

These discrepancies point to several concerns:

High concentration of idle liquidity in a few pools

Possible wash trading in high-volume, low-TVL pools

Inefficient capital allocation across the platform

Need for improved liquidity distribution and incentive structures

Despite these challenges, Raydium's position as the leading protocol for deploying memecoins in the Solana ecosystem has driven impressive financial results. Over the past year, the platform has generated $272 million in fees, and since its inception, it has conducted $35 million (24.19 million RAY) in buybacks, representing 10% of the current supply. This success underscores Raydium's resilience and influence in the DeFi space, even amidst concerns about liquidity distribution and market practices.

Base's Emerging DEX Ecosystem

Layer 2 solutions like Coinbase’s Base are experiencing a significant uptick in DEX activity. Base’s market share within Layer 2s has expanded from 15% to 41% year-over-year, reflecting its growing prominence in the decentralised exchange landscape. Additionally, Base’s current ratio compared to Ethereum sits at 30%, indicating its rapid ascent as a formidable player in the L2 ecosystem. This growth highlights the increasing traction of Base in attracting users and liquidity away from other Layer 2 solutions and even competing with Ethereum's mainnet.

However, Base have its own unique patterns. Uniswap dominates this space, with 98.9% of all new DEX pairs on Base launching on Uniswap, showcasing a strong first-mover advantage.

However, the quality of new pairs remains low; out of the 31,698 "new DEX pairs" created, only 4 pools have over $1 million in TVL and $400,000 in daily volume.

Furthermore, genuine trading activity appears highly concentrated, with Aerodrome capturing 87% of Base’s volume compared to Uniswap V3, indicating that most authentic trading occurs on a single platform. These trends reveal both the dominance of major players and the challenges of liquidity distribution in Base's evolving DEX landscape.

Tron Ecosystem - Sunpump.meme

Following the recent success of memecoins on Solana, Justin Sun, founder of Tron, is now aiming to replicate the meme frenzy within the Tron ecosystem.

SunPump, the first meme fair launch platform on Tron, has rapidly caught the eye of speculative traders. In the last 24 hours, it has outpaced the revenue of the once-dominant Solana-based platform, PumpDotFun. This swift success underscores the escalating trend of meme coin speculation and marks Tron’s rising influence in the memecoin arena.

However, it remains to be seen whether SunPump will have a lasting impact comparable to the transformation brought by memecoins to the Solana ecosystem in early 2024, which significantly altered the DeFi landscape.

The Memecoin Factor: A New Form of Speculation

At the heart of this DEX volume surge lies the memecoin phenomenon, a trend that has taken the crypto world by storm.

The Rise of PumpDotFun

PumpDotFun, a platform facilitating easy token launches, has become a central player in this new ecosystem. Some key statistics:

The platform has generated an impressive $100M in revenue since its inception.

The cost to launch a memecoin on the platform is as low as $2, drastically lowering the barrier to entry for token creation.

This low-cost, high-volume approach to token creation has effectively created a new form of speculative trading, reminiscent of pump-and-dump schemes but operating on a smaller, more frequent scale.

The Memecoin Lifecycle

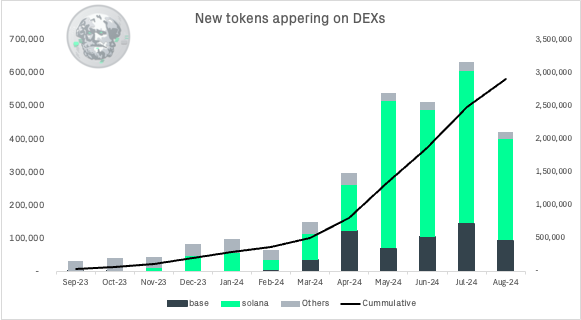

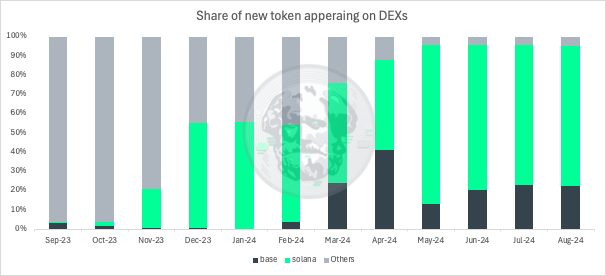

Over the past year, the market has cumulatively added 2.9 million new tokens, the majority of which are memecoins.

Among these, Solana and Base are the leading platforms, with Solana holding the largest market share of 72% and Base following at 22%.

The typical lifecycle of a memecoin on these platforms often follows a pattern:

Creation: A new pool is launched with minimal liquidity.

Wash Trading: The pool is wash traded to create the appearance of activity.

Hype Generation: If the token gains traction, creators sell into the hype.

Abandonment or Relaunch: If the token fails to take off, creators move on to launch a new one.

This cycle can repeat rapidly, with hundreds or thousands of new tokens being created and abandoned in short order.

Impact on Blockchain Ecosystems

Solana's Shifting Economics

The memecoin craze has had a profound impact on Solana's ecosystem, particularly in terms of validator economics:

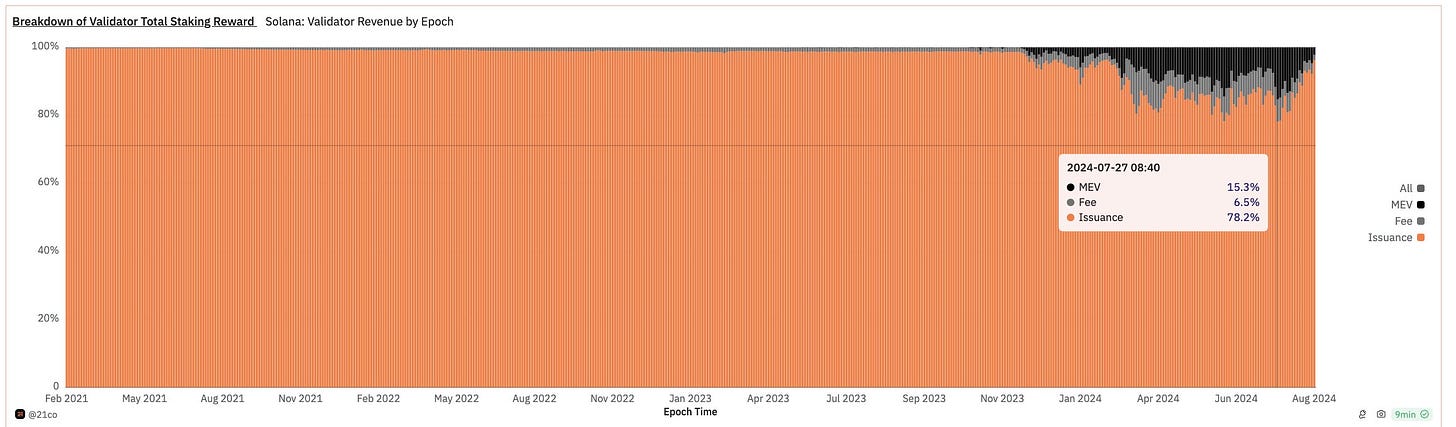

The memecoin frenzy has notably influenced Solana's ecosystem, particularly in validator economics:

Validator Revenue Shift: In early January 2024, validator revenue was dominated by issuance at 95%, with minimal contributions from MEV (1.9%) and fees (3.1%). By July 29, 2024, the landscape had changed dramatically: issuance accounted for 78.2%, MEV surged to 15.3%, and fees rose to 6.5%. This shift underscores the growing significance of DeFi activities, especially memecoin trading, in Solana's economic model.

The MEV Goldmine: The value extracted from memecoins on Solana is substantial. Trading bots have generated $240 million, PumpDotFun has contributed $100 million, and MEV is estimated at around $250 million, totalling $590 million. Additionally, Raydium has accrued $270 million in lifetime fees, though not all of these are from memecoins. This estimate is based on MEV bribes alone; when including MEV profits, the total amount extracted is likely higher. Other factors such as SOL locked in memecoin liquidity pools and extractions by insiders further contribute to this figure.

This dramatic shift underscores the growing importance of DeFi activities, particularly memecoin trading, in Solana's economic model.

Challenges to Solana's Narrative:

Recent developments have cast doubt on Solana's resilience and the sustainability of its economic model:

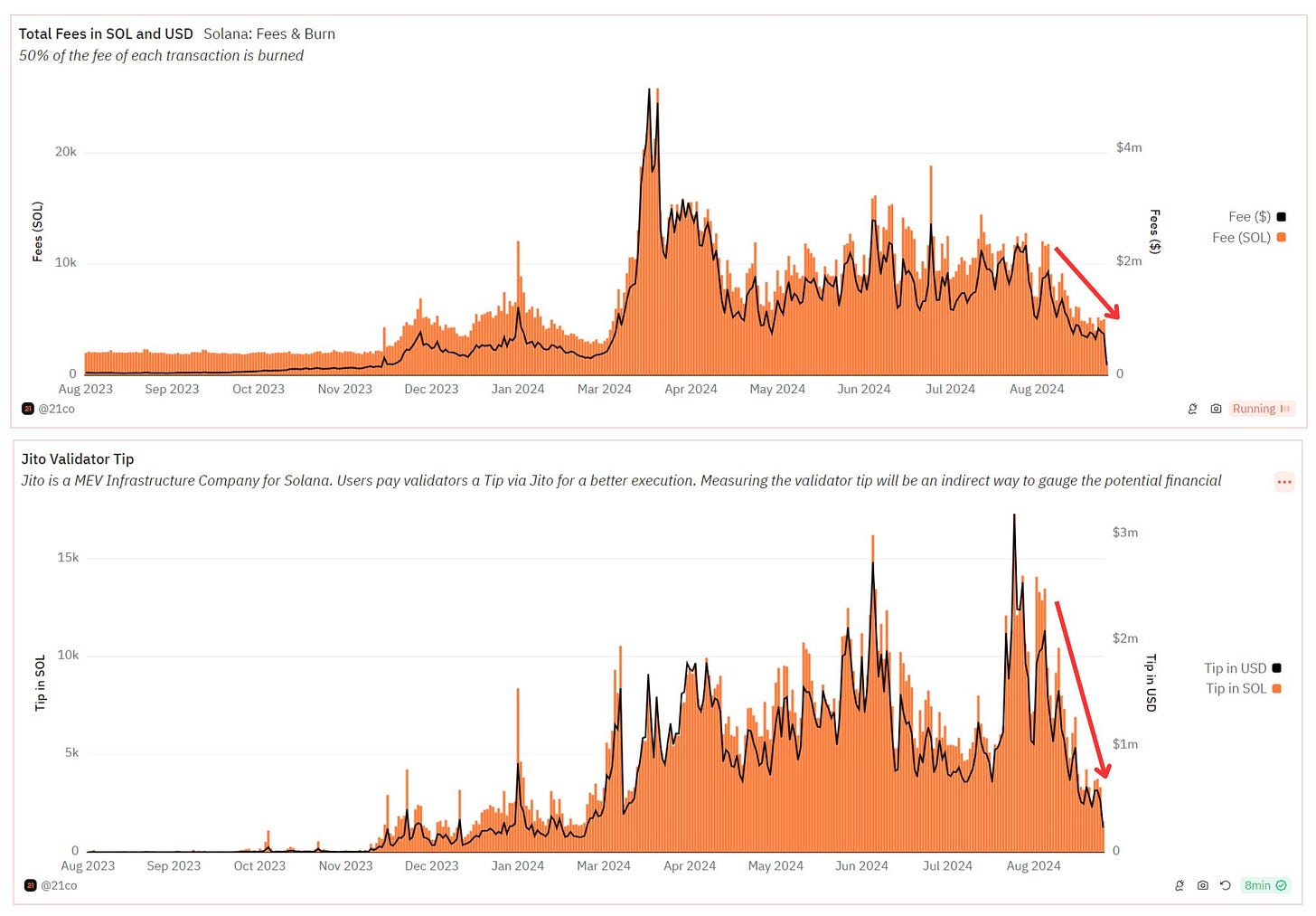

Justin Sun's "Vampire Attack": Sun's strategy revealed Solana's heavy reliance on memecoin fees and MEV. The introduction of a similar platform on Tron resulted in a more than 50% drop in Solana's total fees and Jito tips.

Trading Activity Migration: The swift shift of trading activity to other chains suggests that Solana's so-called "memecoin casino moat" might be less formidable than previously believed.

These factors collectively challenge the stability and competitive edge of Solana's economic framework.

Reshaping DeFi Landscapes

The 2024 surge in DEX volumes and memecoin trading marks a pivotal moment in DeFi's evolution. While driving unprecedented growth, it has exposed both opportunities and vulnerabilities in blockchain ecosystems:

Fluid Liquidity: The ease of capital movement between chains challenges individual blockchain moats, emphasizing the need for continuous innovation.

Shifting Economics: Changes in validator revenue streams, particularly on Solana, highlight DeFi's growing influence on blockchain tokenomics.

Attention Economy: Memecoins have shifted focus from long-term utility to short-term attention capture, reflecting evolving investor behavior.

Market Maturation: Current inefficiencies may spur development of more sophisticated DeFi primitives and risk management tools.

Regulatory Catalyst: The memecoin boom is likely to accelerate regulatory responses, potentially reshaping the legal landscape for digital assets.

While driven by speculation, these trends have catalysed crucial advancements in scalability, interoperability, and economic design. Moving forward, DeFi's success will be measured not by trading volumes, but by its ability to deliver tangible benefits and foster genuine financial innovation.

The challenge ahead lies in balancing the speculative fervor with sustainable growth, as the industry works towards creating a more robust, efficient, and accessible financial ecosystem.